The market for catastrophe bonds, one of this year’s best-performing debt classes, is about to see a significant increase in sales as the World Bank, a major issuer, prepares to ratchet up its offering.

The lender plans to increase the amount it has outstanding in so-called cat bonds to $5 billion over the next five years, compared with $1 billion today. That represents a substantial bump for an overall market that’s currently worth about $40 billion in total.

“It’s ambitious but realistic,” said Michael Bennett, head of market solutions and structured finance in the World Bank’s treasury department.

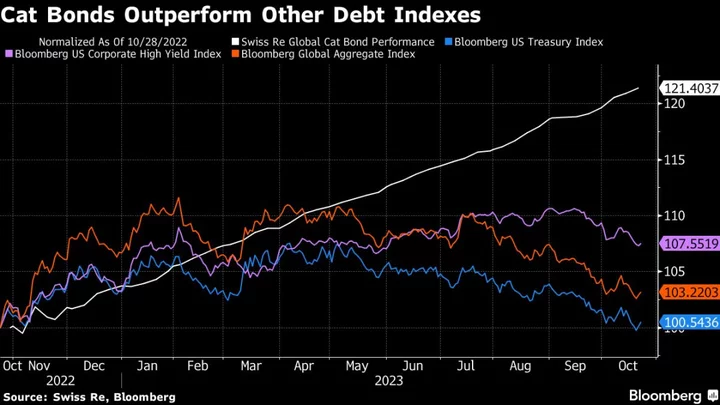

Cat bonds are rising in popularity as their returns trounce those of virtually all other debt markets. This year, the securities are up about 17%, while investors in US Treasuries have lost money. The instruments reward buyers for taking on insurance-market risk, which is rising with the increase in extreme weather events.

Read More: One Bond Market Is Defying Global Selloff With Mega Returns

For the World Bank, which provides financial assistance to developing countries, the plan is to expand the range of natural disasters covered by cat bonds.

“I think you’ll see us doing cat bonds beyond hurricanes, pandemics and earthquakes,” to include physical disasters like floods and droughts, Bennett said in an interview.

Even in some of the wealthiest corners of the world, there’s “not enough insurance coverage” to deal with the potential losses ahead, according to Petra Hielkema, chair of the European Insurance and Occupational Pensions Authority.

“This is important because we’re seeing more frequent and more devastating natural catastrophes affecting our continent than ever before,” she told the economic and monetary affairs committee of the European Parliament this week.

Investors in cat bonds pay the insured party when a contractually defined disaster strikes and specific parameters are met, such as a pre-determined pressure reading during a hurricane. When all the conditions are fulfilled, investors stand to lose some or all their money, which is then used to help cover the cost of the natural disaster in question.

Historically, investors in cat bonds have avoided such payouts most of the time. But of the roughly 30 cat bonds issued by the World Bank in the past decade, about half a dozen have been triggered, requiring investors to cover some or all of the damage against which the issuer sought to protect itself.

The instruments are part of a growing array of securitization models set to be discussed during COP28 climate talks, which start at the end of November in Dubai. Creating attractive financial products around climate risk is key to unlocking some of the vast amounts of private finance needed to help protect vulnerable nations from the fallout of global heating.

“The diversification benefit of protecting countries in the Global South is a significant incentive for private capital in the Global North,” said Ana Gonzalez-Pelaez, a fellow at the University of Cambridge Institute for Sustainability Leadership. “The key to boosting the availability of capital is a consistent source of sufficient premium to underwrite these risks.”

Bennett said the World Bank already has “a couple of transactions in the works,” though he declined to provide details.

Jamaica is due to return to markets in December, when a $185 million hurricane cat bond matures. Colombia and Peru also are looking to tap the market, and there’s talk of a potential regional cat bond spread across Caribbean countries.

“The market is in a better condition now than it was at the end of 2022,” when losses such as those triggered by Hurricane Ian and other disruptions reduced money coming into the sector, Bennett said.

Cat bonds issued by the AAA-rated World Bank typically pay slightly lower returns than equivalent bonds that focus on disasters in richer economies. That said, investors still stand to get a generous risk premium.

“We are now in a market where record premiums are being paid and that’s extremely attractive for investors like us,” said Lorenzo Volpi, deputy chief executive officer at Leadenhall Capital Partners, which has about $900 million of cat bonds in its portfolio, including some issued by the World Bank.

Investors in cat bonds get access to portfolio diversification because their price movements are uncorrelated to those of stocks or other fixed-income instruments. And they’re useful for filling environmental, social and governance mandates from end investors.

One of the biggest holders of cat bonds is Schroders Plc, which oversees a $4.5 billion portfolio of insurance-linked securities, or ILS, a large part of which is in cat bonds. About 3% of that portfolio is invested in World Bank products.

“We have supported most of their deals,” said Daniel Ineichen, Schroders’ head of portfolio management for ILS. “These bonds score very high in our internal ESG ratings because they provide insurance for developing nations that many not be able to otherwise afford the coverage.”

The World Bank’s most recent deal was for Chile, in the form of a joint cat bond and swap deal that provided $630 million of earthquake protection.

Investors were drawn to an expected 1% loss risk and a 4.75% risk premium, according to an analysis by the UK-based Centre for Disaster Protection. That premium is about 60% higher than the historical average for a bond with an equivalent risk profile, according to the CDP, and shows the rising cost that those trying to insure against natural disasters now face.

Volpi of Leadenhall Capital Partners suggests that dynamic has the potential to complicate future issuance. The challenge for the World Bank is persuading governments “to meet a higher level of premium payments to sponsor new issuances” he said.

--With assistance from Greg Ritchie.