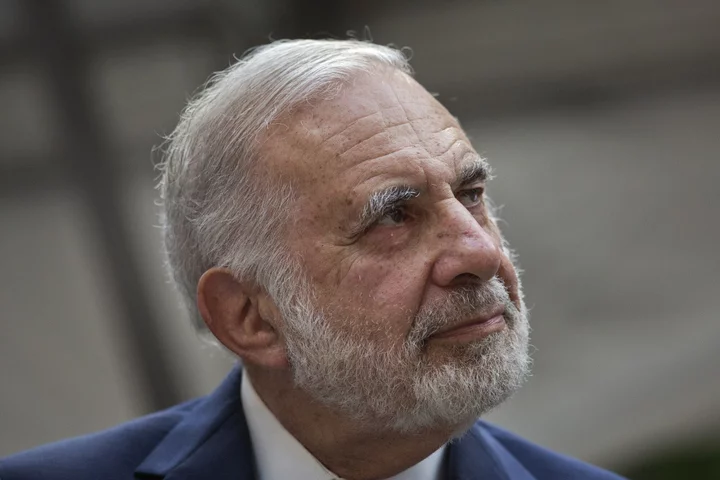

Carl Icahn’s fortune got a $1.1 billion boost Monday after his Icahn Enterprises LP disclosed amended loan agreements with its iconic founder.

The deal essentially severs his loans from the trading price of his company’s shares, allaying investor fears that he may have to liquidate his holdings following a scathing report by short seller Hindenburg Research that sent the stock plummeting by more than half in May.

Icahn Enterprises shares surged 20% to $34.69 in New York trading, lifting the activist investor’s net worth to $11.1 billion, according to the Bloomberg Billionaires Index.

He’s still about $15 billion shy of his 2023 peak in February. But that was before Nate Anderson’s Hindenburg leveled a series of accusations against Icahn’s empire, claiming among other things that it was over-leveraged and trading at an excessively steep premium to its net asset value. The report also emphasized the more than 100 million shares Icahn had pledged as collateral for loans, equal to almost a third of his stake in IEP.

Read More: Carl Icahn Is $15 Billion Poorer After Hunter Becomes the Hunted

Icahn, 87, is Icahn Enterprises’ biggest shareholder with an 85% interest in the investment group, whose holdings span energy, auto dealers, food packaging and real estate among other industries.

Icahn’s reworked deal with creditors, reported earlier by the Wall Street Journal, shifts the trigger for a margin call from the market value of IEP’s shares to the net asset value of its underlying businesses.

--With assistance from Tom Maloney.

(Updates values throughout.)