New signs of stress are emerging in the already battered market for carbon offsets, a popular if controversial climate accounting tool that helps companies and individuals reduce their official carbon emissions.

Demand has all but evaporated for credits generated by the Kariba forestry project in Zimbabwe, one of the world’s largest, said Alfredo Nicastro, head of carbon markets at StoneX Group Inc. At the same time, companies that already own the offsets aren’t deploying them to reduce total emissions tallies at the same pace as in the past.

“I haven’t seen any volumes or trading” for Kariba credits since a new round of criticisms surfaced last week in the New Yorker magazine, Nicastro said. It might never recover from allegations that it overestimated its climate impact, he added, creating “a very damning situation” for Kariba and South Pole, which helped develop the project.

South Pole didn’t respond to a request for comment on trading activity or the value of the Kariba credits. “We diligently follow guidance and methodologies set by established carbon market standards, as they continue to evolve and improve,” it said in a recent statement to Bloomberg on the controversy swirling around Kariba. South Pole will “actively review” its role in the project, it added.

Read More: Faulty Credits Tarnish Billion-Dollar Carbon Offset Seller

For investors and traders of Kariba credits, the drop in demand means losses and possible write downs, Nicastro said: “It’s bad. If you’re heavily positioned in those projects and you’re not moving them around, it’s a significant loss.”

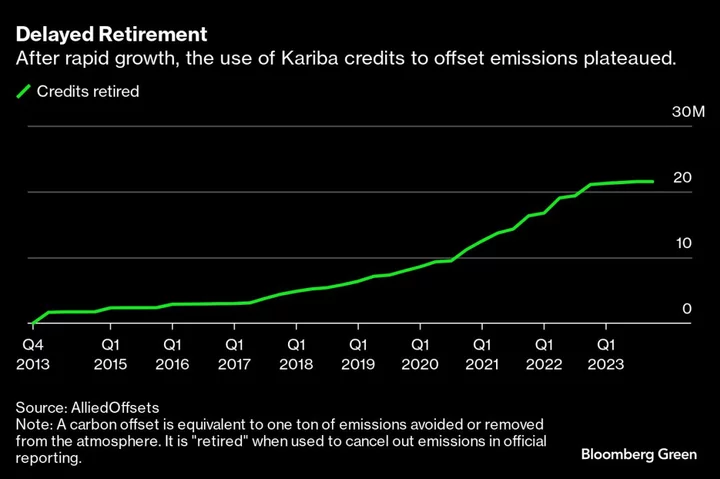

Uncertainties around the Kariba project are adding pressure on a market already strained by weak prices and low liquidity. Buyers aren’t using their credits at the same pace as in the past, according to BloombergNEF. Retirements of Kariba credits have also plateaued, according to data provider AlliedOffsets.

The muted demand is particularly worrisome given that it typically picks up near the end of each year, said Nicastro. About half the carbon credits on the market may be stranded, he said, especially older ones, which may hold up less well under scrutiny.

StoneX has maintained trading volumes at 500,000 tons and is capturing demand from countries, like Mexico, that are going through regulatory overhauls, Nicastro said. It plans to hire three people and add carbon desks in Asia and Europe.

--With assistance from Natasha White and Benjamin Elgin.