More bad news for the London Stock Exchange: British car dealership Lookers announced this morning a deal to go private for almost half a billion pounds. On the politics front, MPs passed a motion on a report that found former Prime Minister Boris Johnson misled Parliament, while the current PM swerved the debate to avoid Tory tensions.

Here’s the key business news from London this morning:

In The City

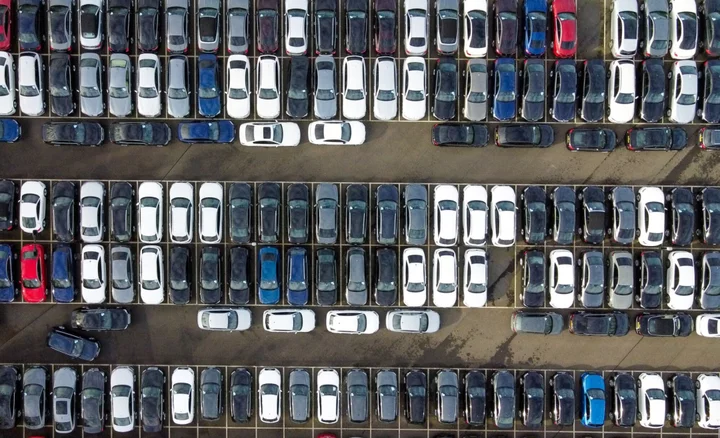

Lookers Plc: The Canadian car dealer network Alpha Auto Group has agreed to buy Lookers for £465.4 million in an all-cash deal.

- The directors of the British car dealership and parts supplier intend to recommend unanimously the offer to shareholders

- Lookers expects the deal will create a stronger platform to grow the company in the UK and potentially expand internationally, with increased access to global capital markets

Saga Plc: The service provider for over-50s sees yearly profit to be “well ahead” of the prior year, benefitting from the momentum in its Cruise and Travel operations.

- The sale process for the group's insurance underwriting business is ongoing, the company also said

IG Design Group Plc: The designer and manufacturer of celebrations products fell into the red in the year ended March 31, reporting a loss after tax of $18.9 million compared with a profit of $2.2 million the previous year.

- Results were driven by adverse foreign currency movements, lower second-half volumes and the strategic decision to continue to exit from unprofitable contracts in the US

In Westminster

British lawmakers voted 354-7 late on Monday to endorse the findings of a probe that concluded former Prime Minister Boris Johnson repeatedly and deliberately misled lawmakers, and stripped him of the right to the automatic access to Parliament enjoyed by former members.

The motion was awkward for current PM Rishi Sunak, who faced balancing the competing demands of avoiding inflaming an internal Conservative Party row and reinforcing his pledge to restore integrity to government. In the event, he sidestepped the debate, drawing claims of weakness from the opposition Labour Party.

The UK has fallen six places down the global economic competitiveness annual rankings because business leaders have lost confidence in the country, due in part to “government incompetence,” an analysis from the International Institute for Management Development shows.

In Case You Missed It

Production costs for UK food and drink manufacturers fell for the first time last month since 2016, an early sign that inflationary pressures in the sector may be starting to ease. The industry’s score on Lloyds Bank Plc’s sector tracker survey fell to 49.4 in May, the first time in more than seven years that it’s been below the crucial no-change level of 50. The decline was driven by falling commodity prices and energy costs.

And women are bearing the brunt of Britain’s struggle to stamp out a stubborn dose of inflation, the country’s leading gender economists warned ahead of figure likely to show underlying price pressures stuck at their highest in 30 years.

Looking Ahead

Tomorrow, official data is expected to show inflation slowed to its lowest in 14 months, while investors are pricing in a 13th consecutive rate hike from the Bank of England to bring wage-price pressures under control. Economists expect the inflation rate to decelerate to 8.4% in May from 8.7% in April. The BOE interest rate decision is next, due the following day.

For a more considered take on the UK's economic and financial news, sign up to Money Distilled with John Stepek.