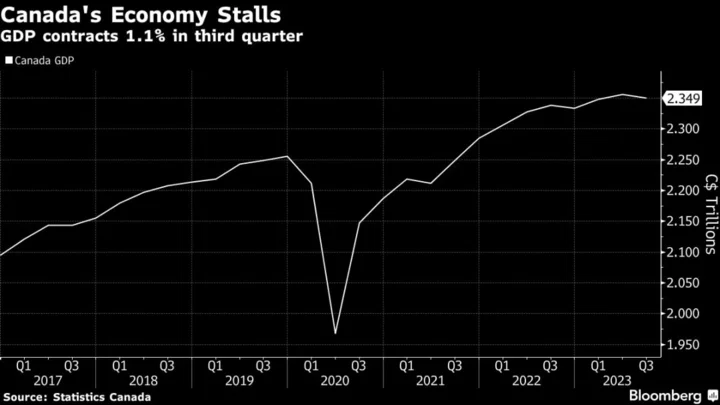

Canada’s economy unexpectedly contracted in the third quarter and consumption flatlined, confirming the central bank’s aggressive interest rate hikes have stalled growth, even with a slight pickup last month.

Preliminary data suggest gross domestic product rose 0.2% in October, as increases in oil and gas extraction, retail trade and construction were partially offset by decreases in the wholesale trade sector, Statistics Canada reported Thursday in Ottawa.

That’d be the strongest monthly growth since May, following a 0.1% expansion in September, which beat expectations for a flat reading in a Bloomberg survey of economists.

Still, Canada’s growth has been substantially weakened. Gross domestic product fell at a 1.1% annualized pace in the third quarter, missing the 0.1% rise expected by economists and the Bank of Canada’s forecast of 0.8%.

Importantly, consumption has been crimped — outside the pandemic, household spending hasn’t been this weak since 2009.

The surprise contraction nearly wiped out all the growth from an upwardly revised 1.4% increase in the second quarter, a rapid deceleration from the robust 2.5% expansion in the first three months of this year.

“The underlying trend still appears to one of muted growth, and a decline in economic activity in per capita terms,” Andrew Grantham, an economist with the Canadian Imperial Bank of Commerce, wrote in a report to investors.

Yields on Canadian government two-year bonds rose about two basis points, while 10-year yields increased five basis points to 3.557%. The loonie dipped about 0.2% to C$1.362 per US dollar as of 8:55 a.m. Ottawa time.

The report reinforces views that the Bank of Canada’s interest rates are sufficiently restrictive to crimp consumption and slow inflation, and will raise questions about how long borrowing costs will stay at terminal before moving lower.

With the economy increasingly showing signs of heading toward a prolonged period of stagnation, the central bank isn’t likely to push borrowing costs above 5%, and may even start considering rate cuts in the first half of next year, especially if disinflation picks up momentum.

After the release traders in overnight swaps brought forward their timing for when the Bank of Canada will start easing monetary policy.

The output data, along with employment figures and the jobless rate to be released Friday, are the last key inputs for policymakers before the next rate decision on Dec. 6. The majority of the forecasters in a Bloomberg survey expect the central bank to keep rates unchanged for the third straight meeting.

Last week, Governor Tiff Macklem said excess demand is gone and the economy is expected to remain weak for the next few quarters, which means “more downward pressure on inflation is in the pipeline.” But he reiterated it’s still too early to think about rate cuts, and that policymakers still need to see clear evidence inflation is firmly on a path toward the target before they consider easing.

In the third quarter, lower exports and slower inventory accumulation led the decline. Household spending was unchanged, even as the country saw record population gains from high levels of immigration.

Business spending in non-residential structures, on machinery and equipment, and on intellectual property all declined. Investment in residential construction rose 8.3% annualized, the first increase since the beginning of 2022.

In September, goods-producing industries led the growth with a first increase in six months, while services industries were unchanged.

There signs that higher rates are working to cool the economy. Real estate, finance and insurance, entertainment and recreation were all contracted that month.

(Updates with market and economist reaction)

Author: Randy Thanthong-Knight