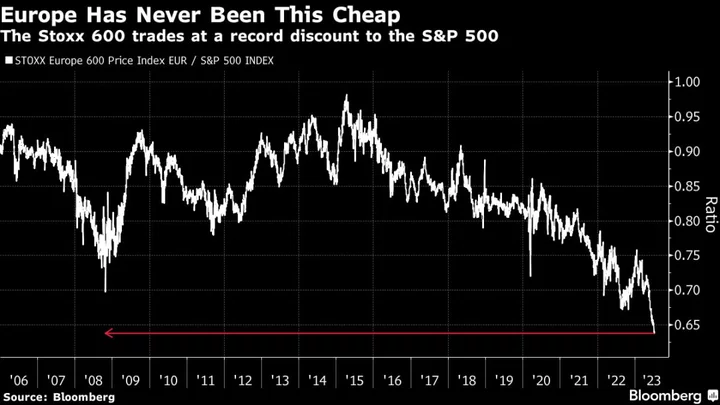

European stocks are the cheapest they’ve ever been compared with their US peers, according to Citigroup Inc. strategists who have adjusted their global asset allocation to reflect this view.

The team led by Beata Manthey raised Europe to overweight while downgrading US equities to neutral. “Europe is once again trading at a record discount, and should benefit from a weaker dollar and any stimulus out of China,” the Citi strategists wrote in a note on Monday.

Based on 12-month forward price-to-earnings ratios, the Stoxx Europe 600 is trading at a 36% discount to the S&P 500. The two equity benchmarks have diverged because the first-half rally on Wall Street was largely driven by tech giants like Apple Inc., Microsoft Corp. and Nvidia Corp.

Manthey, who correctly predicted Europe’s outperformance over the US earlier this year before turning more negative in March, and her team downgraded global information technology stocks. They expect a pullback in megacap growth shares, but said they will look to buy these dips.

As US stocks advanced this year, gains in Europe stalled as concerns of an uneven recovery in China and worries of higher interest rates weighed on equities. Chinese inflation data on Monday fueled fears around the risk of deflation and added to speculation about potential economic stimulus by Beijing.

The Citi strategists also upgraded emerging-market stocks to overweight while downgrading UK shares to neutral, reflecting the London exchange’s lack of exposure to growth stocks, while a stronger pound could continue to be a drag.

Morgan Stanley Strategists Say UK Assets Are World’s Cheapest

On the outlook for company profits, Manthey and her peers forecast a modest earnings-per-share slowdown, rather than a full recession. “Risks to the economic outlook are more balanced. ‘Soft landing’ scenarios look plausible, but tightening credit conditions remain a key headwind,” they wrote in the note.