Having unlocked stock market riches in 2023, the “artificial intelligence” catchphrase faces a shift in sentiment — and Broadcom Inc.’s earnings will test whether euphoria is fading.

There are signs investors have become more selective as the tech rally stalled this month. Nvidia Corp.’s shares had a tepid initial reaction to results that beat lofty expectations, while Marvell Technology Inc. — another chipmaker with AI exposure — slumped after its own report. Such reactions are worrisome for the market, particularly for companies banking on a jolt from AI sales.

“There is some fatigue around the AI trade, investors are nervous about the market, and there’s less incentive to buy given uncertainty surrounding the Fed,” said Jordan Klein, a tech-sector specialist at Mizuho Securities. Investor reaction to Broadcom’s outlook will be an important read on the sector, he said.

Shares of Broadcom rose 1% on Thursday.

Broadcom said last quarter that sales related to AI will double this year, and the stock’s 61% gain in 2023 has outperformed both the Philadelphia semiconductor index and the Nasdaq 100.

Delivering on that forecast would’ve likely sent the chipmaker’s shares soaring a couple weeks ago. Now, after Nvidia’s blowout fell relatively flat, Broadcom’s 10-quarter streak of rising the day after earnings could be in jeopardy. The options market is implying a one-day move of 4.4% in either direction on the day after the report.

Read more: Broadcom AI Offerings Boost Results Amid Slowing Sales: Preview

Headwinds have been persistent. The Federal Reserve has signaled interest rates will stay higher for longer than expected, recession worries are still lingering, and multiples look elevated after a strong year-to-date advance. A basket of stocks tracked by Goldman Sachs Group Inc. that are expected to benefit most from artificial intelligence has retreated from a peak at the start of the month.

“The market is enamored with AI, but people are very aware of the run-up that has occurred, and there’s a history of tech investors extrapolating growth out too quickly,” said Kevin Caron, senior portfolio manager at Washington Crossing Advisors. “The AI trade will play out over years, but we’re now assessing who is actually seeing better growth and profitability, and how attractive they look given valuations and rate policy.”

When Broadcom reports later Thursday, analysts expect revenue growth of 4.8% on net earnings growth of almost 14%, according to data compiled by Bloomberg. This consensus hasn’t budged over the past month, even as Nvidia’s report cemented how there continues to be massive demand for the chips used in processing AI services.

Read more: Nvidia Partner Expects AI Server Sales to Double in 2024

One mark in Broadcom’s favor is its valuation. The stock trades at 20 times estimated earnings, and while that represents a premium to its long-term average, it’s well below Nvidia at 36 or Marvell at nearly 29. It also trades at a discount to both the overall semiconductor index and the Nasdaq 100, while offering one of the higher dividend yields among chipmakers.

Furthermore, there has also been progress in the company’s $61 billion acquisition of VMware Inc., which Broadcom expects will close near the end of October.

“Broadcom is very diversified with an attractive AI business, it has good cash flow, and the valuation is more attractive, which makes it a good buy-and-hold stock as opposed to a momentum play,” Mizuho’s Klein said.

“However, it isn’t going to guide as aggressively as Nvidia, and there is a sense that if even Nvidia couldn’t rally on its forecast, what chance does any other company have.”

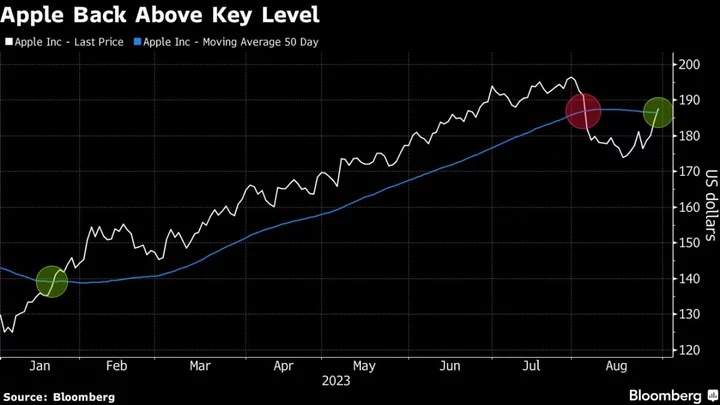

Tech Chart of the Day

Apple gained 1.9% on Wednesday, a rally that took the iPhone maker back above its 50-day moving average, a positive sign for short-term momentum trends. The stock fell below this closely watched level earlier this month.

Top Tech Stories

- Apple Inc. is testing the use of 3D printers to produce the steel chassis used by some of its upcoming smartwatches, according to people with knowledge of the matter, heralding a major change to how the company manufactures products.

- X, the social network that used to be known as Twitter, updated its privacy policy to include a new kind of user data it plans to collect: biometric.

- China approved the first batch of generative artificial intelligence services for public rollout, freeing up homegrown technology champions including Baidu Inc. and SenseTime Group Inc. to openly compete with the likes of OpenAI Inc. and Microsoft Corp.

- A Tesla Inc. plan to purchase hard-to-get construction materials is being investigated by US prosecutors, who are looking at whether the project was an appropriate use of company funds.

- Chinese state media jumped aboard a groundswell of national pride surrounding Huawei Technologies Co.’s latest smartphone, portraying the gadget as a technological marvel that delivered a much-needed victory over US sanctions.

- Japan’s economy ministry is seeking a budget of more than ¥120 billion ($822 million) to strengthen the country’s semiconductor sector next year, as the nation positions chips at the core of its economic security policy.

Earnings Due Thursday

- Premarket

- Ciena

- Chindata

- Hello Group

- Postmarket

- Broadcom

- VMware

- Dell Technologies

- MongoDB

- Nutanix

- Elastic

--With assistance from Subrat Patnaik and Rheaa Rao.

(Updates to market open.)