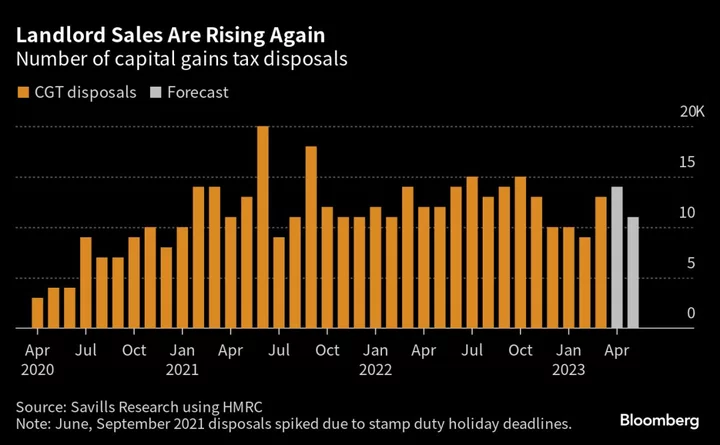

The bad news keeps on coming for Britain’s rental market as a rise in tax proceeds from property disposals hints at a bigger-than-expected selloff by the nation’s landlords.

The amount of homes sold by landlords rose to 25,000 between April and May from 22,000 in February and March, according to forecasts based on an analysis of capital gains tax receipts compiled by Savills Plc.

What’s more, the UK tax authority HM Revenue and Customs has revised up the 2021/22 tax year disposal figures by 8.5% to 153,000, suggesting landlords could have been offloading properties even earlier than first thought.

“The rise in residential disposals in capital gains tax receipts does point to a greater number of buy-to-let landlords selling up,” said Toby Parsloe, a research analyst at Savills. “This trend started earlier than previously thought, picking up pace since the market opened again in June 2021 after Covid.”

Mortgage Strain

UK households are facing an avalanche of pressures triggered by rising interest rates and the worst cost-of-living crisis in a generation. Meanwhile, tenants are bearing the brunt of the turmoil as landlords — whose interest-only mortgages are particularly exposed to rate hikes — either sell up or hike rents to deal with extra costs.

Read more: UK Adults Stay With Parents and Give Up on Property

Landlords pay CGT on any gains when they sell a property. The receipts over the year serve as a proxy for BTL sales because property that doesn’t count as a main residence is the only asset where the tax is due within 60 days, rather than at the end of the tax year of disposal.

However, buy-to-let investors choosing to run their properties through a limited company are not liable for capital gains tax, meaning even more landlords could be selling up than the data reveals.

Savills’ analysis — which models sales using the monthly make up of receipts between residential and non-residential property — shows there were 151,000 home disposals in the 2022/23 financial year, the second highest on record after the previous tax year when there were 153,000.

What’s more, landlord sales in the first half of 2023 made gains which were 10% lower than those who sold last year, with 6% selling at a loss, according to a separate report by broker Hamptons International.

“There are signs that landlords looking to sell today may have missed the top of the market,” said Aneisha Beveridge, head of research at Hamptons. “In the run up to remortgaging, landlords are fighting to balance the books by paying down debt and hiking rents that have dropped below market rate.”

The selloff is backed up by consultancy TwentyCi, which said the number of privately rented homes available in the UK dropped to a 14-year low in June. Meanwhile, the crunch in supply caused the cost of a new tenancy in Britain to rise almost 10% year-on-year to an average £1,282 in July, according to Hamptons.

Read more: UK Buy-to-Let Mortgages Sliding Into Arrears Surge by Almost 30%

While Savills’ forecasts suggest landlord sales are rising, the April and May disposals remain below the total seen in the two months following Liz Truss’s September mini-budget. However, the broker said HMRC’s revisions to the 2021/22 figures creates the possibility that disposals over the past year may also be higher than the current data show.

“For many landlords it simply isn’t worth it anymore, increasing the very real risk that more will be looking to exit the sector,” Savills’ Parsloe added.