Brazil raised its estimate for this year’s budget gap to account for rising government spending and declining revenue amid a weakening economy.

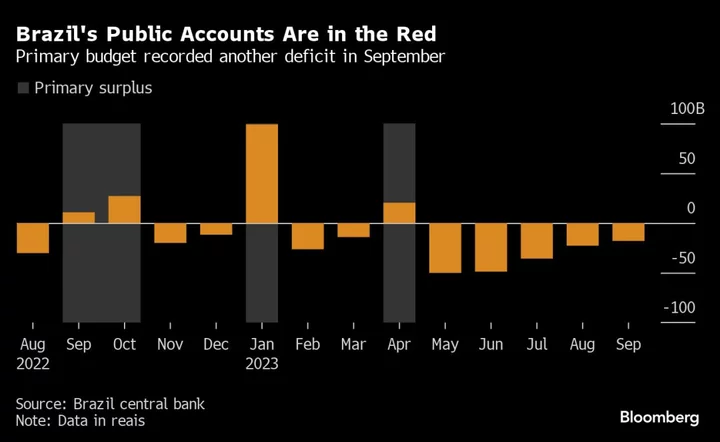

The primary fiscal deficit, which doesn’t take into account interest payments, will reach 177.4 billion reais ($36.1 billion) this year, compared with a previous forecast of 141.4 billion reais, according to an official report published Wednesday.

Public expenses were revised up by an additional 21.9 billion reais, while revenues are forecast to be 22.8 billion reais lower.

The Brazilian real briefly erased gains when the new estimates were published, weakening as much as 0.4% in Sao Paulo, as investors worry that President Luiz Inacio Lula da Silva will push to further boost spending in 2024 to shore up an expected decline in Latin America’s largest economy. Investors’ fiscal concerns also threaten a recent rally that pushed Brazilian stocks near record highs.

“This is just the confirmation of what we have been alerting: that expenditure was underestimated and revenue overestimated,” said Alberto Ramos, chief economist for Latin America at Goldman Sachs Group Inc. “These developments make it abundantly clear that the government has little inclination to contain spending, much less cut it.”

Worries about Lula’s unwillingness to rein in public spending have been growing since the leftist president said his administration was unlikely to meet Finance Minister Fernando Haddad’s pledge to eliminate the deficit next year because that would require cutting billions of reais from projects that are a priority for the government.

Read More: Lula Says Brazil Unlikely to Hit 2024 Zero-Deficit Target

Haddad managed to convince Lula and his allies to keep the 2024 fiscal target unchanged, but few believe he’ll be able to deliver on the zero-deficit pledge, given it would require a series of tax increases and other measures to boost revenue that need congressional approval.

“Any news that implies less fiscal responsibility in Brazil is going to create some volatility in local markets,” said Brendan McKenna, a strategist at Wells Fargo. “I’m becoming more concerned.”

--With assistance from Vinícius Andrade, Leda Alvim and Felipe Saturnino.

(Updates with context and comments from economists starting in fifth paragraph.)