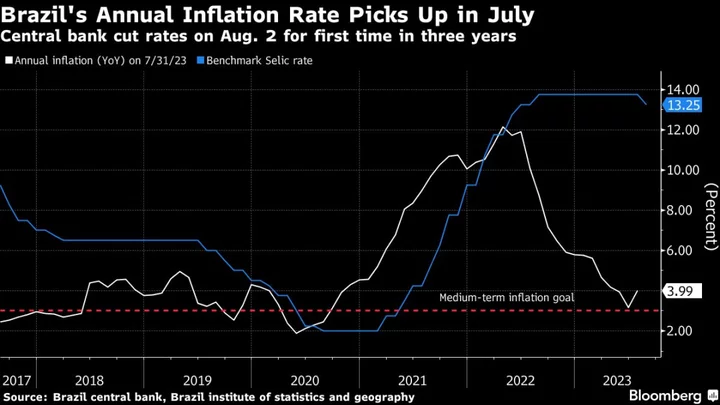

Brazil’s annual inflation accelerated for the first time in over a year, topping economist expectations, as the central bank signals plans to keep cutting interest rates by 50 basis points.

Consumer prices rose 3.99% in July from a year earlier, more than the 3.94% median estimate from analysts in a Bloomberg survey. From the previous month, prices rose 0.12%, the national statistics institute reported on Friday.

Annual inflation in Latin America’s largest economy is ticking up largely due to comparisons to the year-ago period when a wide range of tax cuts took effect. Still, central bankers led by Roberto Campos Neto have signaled plans to continue cutting interest rates at a pace of 50 basis points as demand weakens. By contrast, policymakers in countries such as the US and the UK have recently raised their borrowing costs.

Read More: Fed Loses to Hyperinflation-Scarred Brazil in Race to Cut Rates

The rise in the inflation rate “won’t stop Copom from lowering interest rates at its September meeting,” William Jackson, chief emerging market economist at Capital Economics, wrote in a note. “By the same token, however, the figure probably rules out the possibility of a larger rate cut than the 50 basis points delivered earlier this month.”

What Bloomberg Economics Says

“A low headline and tame core inflation in July keep the road clear for another policy rate cut at the Brazilian central bank’s Sept. 20 meeting. Save for an exceptionally strong decline in inflation expectations and the core measures in the mid- and full-month prints for August, we think the BCB will stick to its forward guidance of another 50-basis-point move, bringing the policy rate to 12.75%.”

— Adriana Dupita, Brazil economist

Click here to read the full report.

Transportation costs were the biggest monthly inflation driver, surging 1.5% compared to June as gasoline leaped by 4.75%, according to the national statistics institute. On the other hand, housing fell by 1.01%, while food and beverages declined 0.46%.

Price pressures in Brazil’s services sector will be a focus in the central bankers’ push to bring inflation to its goal, Campos Neto said in a public hearing on Thursday. Inflation estimates for year-end 2025 are very close to target, he said.

Services inflation in July decelerated from the previous month, according to Cristiano Oliveira, chief economist at Banco Pine SA, who added that the report showed a “benign outlook” for monetary policy.

Policymakers aim for annual inflation at 3.25% this year and then 3% through 2026. Most analysts in a weekly central bank survey see consumer price increases above targets through the foreseeable future.

After pushing for lower rates for months, members of President Luiz Inacio Lula da Silva’s government welcomed the bank’s first rate cut on Aug. 2. Finance Minister Fernando Haddad said the reduction was “fruit of dialogue.”

It was the first policy meeting for new board member Gabriel Galipolo, Lula’s former deputy finance minister who is expected to succeed Campos Neto when his term ends in 2024.

Read More: Brazil Central Bank Says Faster Key Rate Cuts Are Unlikely

--With assistance from Rafael Gayol and Fernando Travaglini.

(Updates with economist quotes and details from July inflation report starting in fourth paragraph)