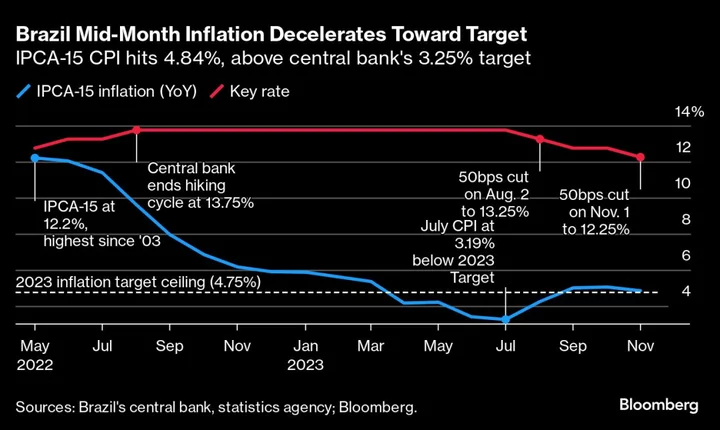

Brazil’s annual inflation slowed roughly in line with expectations in early November, approaching the target range as central bankers forge ahead with plans for more monetary easing.

Official data released Tuesday showed consumer prices rose 4.84% from a year earlier, slightly more than the 4.82% median estimate of analysts surveyed by Bloomberg. Monthly inflation hit 0.33%.

Central bankers led by Roberto Campos Neto are now relaxing monetary policy after bringing down inflation from a roughly two-decade high. They plan to maintain their pace of half-point rate cuts through their next two meetings, moves that would bring the benchmark Selic to 11.25% by the end of January.

Read More: Brazil Central Bank Can Keep Cutting Rates, Campos Neto Says

What Bloomberg Economics Says:

A rise in food prices and the third consecutive month of double-digit jump in airline tickets weighed on the headline print, but our estimate of the smoothed trimmed means core (0.42% month over month) also ticked up. In all, the print allows the BCB to keep easing its uber-tight policy, but does not encourage accelerating the easing path.

— Adriana Dupita, Brazil and Argentina economist

Eight out of nine groups of goods and services became more expensive during the period. Food and beverage costs increased 0.82% on the month, representing the main inflation driver, while transportation rose 0.18%.

While inflation has slowed overall, more expensive fuel has caused concern within President Luiz Inacio Lula da Silva’s government. State-controlled oil firm Petroleo Brasileiro SA, which sets wholesale gasoline and diesel costs, has faced pressure for cheaper jet fuel to help reverse a spike in airfares and keep cost-of-living increases under control.

The annual inflation rate remains above the 4.5% ceiling of the central bank’s target range for 2024, but analysts widely expect that double-digit borrowing costs will cause it to fall in coming weeks.

--With assistance from Giovanna Serafim.

(Updates with details from release and economist comments starting in fourth paragraph)