BP Plc raised its dividend by 10% and said it would buy back another $1.5 billion of shares, even as its second-quarter profit fell by more than expected amid weaker oil and gas prices.

The results follow the pattern set by Big Oil peers Shell Plc, TotalEnergies SE, ExxonMobil Corp. and Chevron Corp., all of which have focused on increasing returns to investors even as the surge in energy prices that spurred last year’s record profits has abated.

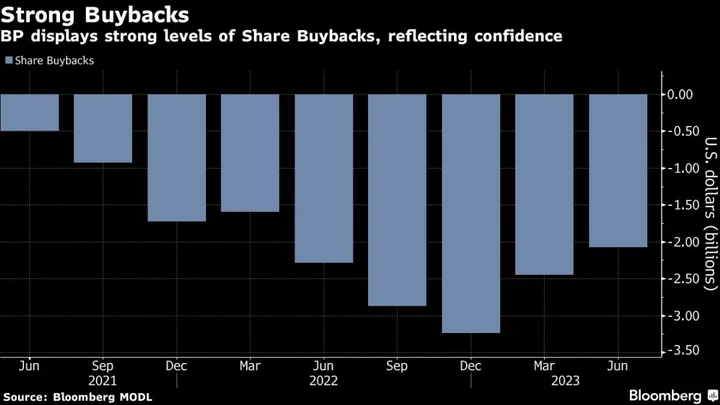

BP’s shareholder returns are now well in excess of the company’s guidance. It had previously indicated that it expected to buy back about $4 billion of shares and raise the dividend by 4% each year, assuming the price of Brent crude was about $60 a barrel. Over the past 4 quarters the company has repurchased $10 billion of shares and increased its dividend by a fifth.

“We’re delivering for shareholders growing our dividend and announcing a further share buyback,” Chief Executive Officer Bernard Looney said in a statement on Tuesday. “This reflects confidence in our performance and the outlook for cash flow.”

These large cash payouts have drawn some criticism at a time when many countries are grappling with a cost-of-living crisis and the world needs huge amounts of investment into low-carbon energy to tackle climate change. BP has pledged to boost spending on both oil and gas and renewables.

BP’s second-quarter adjusted net income was $2.59 billion, down from $8.45 billion a year earlier and below the average analyst estimate of $3.51 billion.

The company is sticking to its plan for capital expenditure of $16 billion to $18 billion this year. So far it’s spent $7.9 billion, putting it on pace to reach the lower end of this range.

The buyback and dividend increase against a backdrop of weaker earnings had one important side effect — higher debt. Net debt rose more than $2 billion from the previous quarter to $23.7 billion, although that’s still much lower than a few years ago.

(Updates with details on shareholder returns in third paragraph.)