Companies are seizing the opportunity to sell more bonds as rates march higher and the economy slows.

European borrowers raised the most debt in over a year as another policy rate hit a 15-year peak, while US borrowers piled in after regional banks found their feet. Last week’s spree is expected to extend as companies exit earnings blackouts, spurred to move fast before recession bites.

“We will continue to see more of the same as we head towards the end of June, assuming the market remains supportive,” said Marco Baldini, global head of investment grade syndicate at Barclays Plc.

Funding conditions have eased since the height of financial-sector volatility in March, with US new issue concessions and average yields dropping. Strong secondary performance from the most recent batch of bonds bodes well for the streak to continue.

Another $30 billion in US high-grade bond issuance is expected next week, in line with the prior five-day period. Blue-chip US companies are forecast to raise $135 billion in May, which tends to be a busy month, up from about $70 billion last month.

“The strong issuance we have seen this week is a response to corporates globally exiting their blackout restrictions around earnings and into an improving rate environment, while having passed some key economic data,” said James Cunniffe, HSBC Holdings Plc’s head of corporate and structured debt capital markets syndicate for Europe.

High-grade issuers are having to time deals with care to avoid a minefield of economic data — particularly on inflation — that’s been roiling global markets. Windows to sell new debt slam shut as fast as they open, while good days to fund quickly become crowded, forcing some to wait.

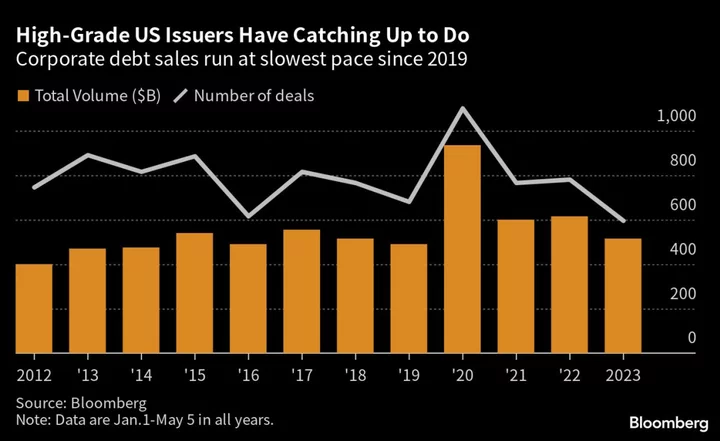

US companies have a large chunk of debt to refinance, and with year-to-date issuance running about 10% lower than in 2022, they have catching up to do. Blue-chip firms have an estimated $427 billion maturing from the second to the fourth quarter of this year, according to S&P Global Ratings.

Funding costs are very unlikely to get cheaper for companies in the medium term, regional banks aren’t yet out of the woods and debt ceiling talks are expected to fuel volatility. As long as demand for the debt remains strong, expect companies to sell more bonds while they can.

Listen to the latest episode of the Credit Edge Podcast

Elsewhere, the outcome of Turkey’s elections on Sunday could be the start of a turnaround in the nation’s debt and currency markets, long shunned by international investors. An election victory by the opposition and restoration of market-friendly policies could fuel a rally in both Turkish debt and broader emerging market indexes.

Elsewhere:

- Giants of the $1.4 trillion private credit industry are cutting discreet side deals that grant them sweeter terms than other lenders when financing leveraged buyouts, according to people with direct knowledge of the matter. Blackstone Inc., Ares Management Corp., Apollo Global Management Inc., HPS Investment Partners and Goldman Sachs Group Inc.’s asset management division are among a number of funds to have used so-called side letters.

- Europe’s $300 billion collateralized loan obligation market is grinding to a halt amid a sharp drop in M&A. Fewer companies and buyout firms are doing big deals, and that means less demand for the leveraged loans that finance them. That’s a big problem for CLOs, which repackage loans and sell them on.

- So-called Chapter 22 filings in the US — industry slang for repeat bankruptcies — are piling up at the fastest rate since the Great Recession, according to BankruptcyData. The trend is both a sign of how fragile the economy has become and a failure of the bankruptcy system, considered among the best in the world.

- Chinese junk dollar bonds are falling in their longest losing streak since July and average prices have hit a five-month low, as new data showing signs of weakness in the property market crushed investor optimism about a recovery.

- Conglomerate Dalian Wanda Group is in talks with major Chinese banks on a loan relief — a sign that the company faces a liquidity challenge. The news sent Wanda’s dollar bonds as well as the broader high-yield property bond market tumbling.

- Singapore-based logistic real estate company GLP Pte Ltd told investors it plans to sell some assets in China in a push to pare debt levels after announcing a 68% drop for net income in 2022. The company’s investment-grade status could be at risk if there’s a lack of progress for the deal, Fitch Ratings warned.

--With assistance from Richard Annerquaye Abbey, Finbarr Flynn, Selcuk Gokoluk and Allan Lopez.