Bond investors are beginning to look beyond the debt-ceiling quagmire even as Treasury Secretary Janet Yellen’s warnings about when the US will run out of borrowing capacity become more pointed. What lies beyond is a bit troubling.

While the Treasury department’s cash pile has slumped to levels last seen in 2017 and the amount of special measures it has available to keep it from breaching the statutory borrowing limit are shrinking, negotiators in Washington have been moving closer to an agreement to raise the nation’s borrowing capacity. As a result, market concern about the prospect of Treasury payments being skipped has eased somewhat. Short-dated bill yields have retreated from their extremes, as has pricing on credit default swaps. But there are new concerns on the horizon, some stemming from the very resolution of the debt crisis that’s shaping up as an increasingly likely possibility.

In the Treasury market, the easing of debt-cap recession risks means the focus can shift once more to economic fundamentals and the outlook for Federal Reserve policy, as well as the effect of any potential Congressional deal on both markets and economic activity.

The central bank’s preferred gauge of inflation is still running hotter than many had anticipated and traders have been ramping up their bets on at least one more bout of tightening by Chair Jerome Powell in the coming months. Traders are now back to pricing in a scenario for higher interest rates that’s largely been absent since concerns about regional banks upended markets earlier this year and Treasury yields have been on a seemingly relentless march higher with the two-year rate topping 4.6%.

Against that backdrop, investors will be zeroing in on major macro indicators, like next week’s monthly jobs report, and parsing public comments from Fed officials.

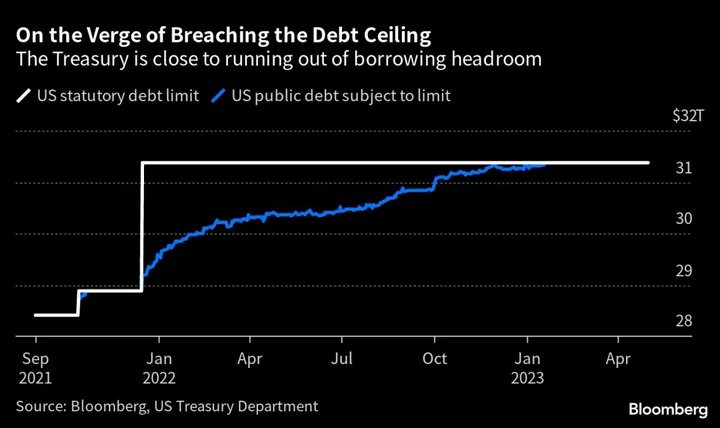

Any debt-ceiling agreement itself will also probably cast a shadow. If, as seems likely, it includes caps on spending, there could be an additional drag on growth from the budget which will in turn impact monetary policy choices. Also of concern is the fallout from moves by the Treasury to replenish its emaciated cash balance. That dwindling pile— combined with the gradual exhaustion of accounting gimmicks aimed at keeping the US from breaching its cap — has seen Yellen warn once again that things are getting tight, telling lawmakers on Friday that the government expects to be able to make payments only up until June 5.

It also means there will be that much more issuance to do in order to bring cash up to more normal levels if and when a deal is struck. The resulting deluge of bill sales is likely to suck a significant amount of liquidity out of markets, tightening financial conditions and adding pressures at a time when higher central bank interest rates and shrinkage of the Federal Reserve balance sheet are already creating tension.

“The bond market is looking past the debt limit now” and refocusing on some of the issues that prevailed before the banking upheaval in March, said Tom Essaye, a former Merrill Lynch trader who founded The Sevens Report. “The jobs report next week is going to be even more important than some people realize, because if it comes in hot the Fed will hike again in June,” he said in a phone interview.

That said, an on the debt ceiling is still not a done deal and observers will still be keeping a wary eye for signs of stress. From Washington to Wall Street, here’s what to watch on the debt ceiling, the economy and policy in the coming week:

Washington Wrangling

While negotiators for the White House and Congressional leadership appear to be moving closer to an agreement, there are ongoing risks. Talks could stall, of course, but even if there is an agreement, it still has to get through various legislative hurdles. Until it becomes law, the government’s likely to keep bleeding cash and eating into the accounting gimmicks it’s been using to avoid breaching the ceiling. So every day of delay counts.

“Based on the most recent available data, we now estimate that Treasury will have insufficient resources to satisfy the government’s obligations if Congress has not raised or suspended the debt limit by June 5,” Yellen said Friday in her latest letter to lawmakers on the potential timing of a government default.

The Cash Balance and Extraordinary Measures

The amount that sits in the US government’s checking account fluctuates daily depending on spending, tax receipts, debt repayments and the proceeds of new borrowing. If it gets too close to zero for the Treasury’s comfort that could be a problem. As of Thursday there was less than $39 billion left and investors will be watching each new day’s release on that figure carefully. Focus is also on the so-called extraordinary measures that the Treasury is using to eke out its borrowing capacity. As of Tuesday that was down to a mere $67 billion.

Rating Agencies

Hovering over the whole debt-ceiling fight, meanwhile, is the risk that one of the major global credit assessors might choose to change their views on the US sovereign rating. Fitch Ratings this week issued a warning that it could opt to cut the country’s top credit score, a market-roiling step that Standard & Poor’s took back during the 2011 debt-limit fight. This time around both S&P and Moody’s Investors Service have refrained from shifting their outlooks, although that is potentially a risk and investors will be clued in to anything that the major rating agencies might say about the situation, even if an agreement is concluded.

Economic Data Releases

- May 30: Home prices; consumer confidence; Dallas Fed manufacturing gauge

- May 31: Mortgage applications; MNI Chicago purchasing managers index; Jolts job openings; Dallas Fed services gauge; Fed Beige Book

- June 1: Challenger job cuts; ADP employment report; nonfarm productivity; weekly jobless claims; S&P Global US manufacturing PMI; construction spending; ISM manufacturing report; vehicle sales

- June 2: Monthly jobs report

Fed Speakers

- May 30: Richmond Fed’s Tom Barkin

- May 31: Boston Fed’s Susan Collins; Governor Michelle Bowman; Philadelphia Fed’s Patrick Harker; Governor Phillip Jefferson

- June 1: Harker

Auctions

- May 30: 13- and 26-week bills; 161-day cash management bill

- May 31: 17-week bills

- June 1: 4- and 8-week bills

(Updates with Yellen latest, cash balance and extraordinary measures information.)