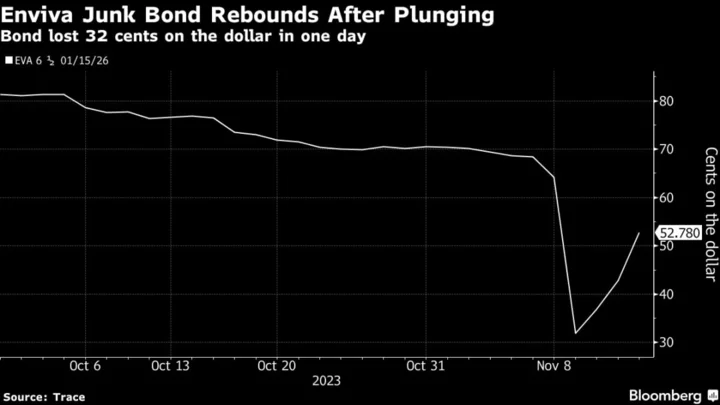

The first trade hit the tape at 9:54 a.m. The price: 38 cents on the dollar. These were the bonds of a little-known company called Enviva Inc., a wood-pellet maker in Bethesda, Maryland. Just the night before, on Nov. 8, they had closed at 64 cents. The rout deepened rapidly as the day went on, sending the bonds to as low as 31 cents.

Days earlier, something similar happened to Dish Network Corp. — its bonds sinking into free-fall and wiping out some $10 million in value within hours — and then to WideOpenWest, a cable-service provider, and to Beauty Health Co., a skin-care company, after reporting quarterly earnings.

Debt investors are in no mood to tolerate bad news. Not when they can now get over 5% risk-free — instead of the near-0% that reigned for years — on US Treasury bills. The news was quite bad in all of these cases — Enviva even suggested it might have to close its doors — and so a market reaction was always inevitable. But it’s the speed and violence of the declines that are raising eyebrows. To some, the moves feel more akin to the hair-trigger responses in stocks, a market traditionally far more volatile than bonds.

“This is something unusual relative to the past couple of years,” said Christian Hoffmann, portfolio manager at Thornburg Investment Management. “Capital is more constrained, and people are taking a harder look at cash flow and business models.”

Analysts at Barclays Plc agree. Nearly a quarter of all bond moves of at least 1 cent on the dollar in the three months through March were in reaction to earnings, up from 18% in 2022, they said in a report.

Another market dynamic could also be at play, market watchers say. Prices of bonds may be declining more sharply because banks, which act as middlemen between sellers and buyers, can no longer hold as much risk on their balance sheets. To lure buyers for bonds that investors are eager to sell, banks are offering steeper discounts.

Yet cratering prices are attractive to distressed buyers, which can then end up boosting demand for risky bonds and loans, said Nichole Hammond, senior portfolio manager at Angel Oak Capital Advisors.

Enviva’s 6.5% note maturing in 2026 at one point had gained more than 20 cents after it plummeted in secondary trading, according to Trace data. Prices of Spirit Airlines Inc.’s bonds are slowly recovering after bad news, and iHeartMedia Inc.’s debt is turning a corner after the company’s disappointing fourth-quarter forecast.

Still, expect more action as corporate borrowers continue to report earnings, said John McClain, portfolio manager at Brandywine Global Investment Management.

“There’s definitely more fireworks to come,” he said. “We’ll see who’s winning, who’s not, who’s spending. As the consumer starts to get pinched, we’ll start to see more negative headlines.”

Week in Review

- Media executive Byron Allen is weighing a bid for several television stations from broadcaster E.W. Scripps Co. and is seeking funding from the private debt market to pay for the potential deal.

- HPS Investment Partners is poised to provide a roughly €750 million ($802 million) direct loan package for EasyPark AB to support its acquisition of a rival firm.

- Banks are aiming to syndicate the over €1 billion ($1.1 billion) debt package financing Cinven’s buyout of Synlab AG by year-end.

- Investment banks and private lending firms are working on plans to provide as much as €3 billion ($3.3 billion) of debt to back a potential buyout of Techem GmbH.

- Dalian Wanda is facing a fresh bout of stress as pre-IPO backers of the company’s commercial unit rejected an initial proposal to delay the repayment of over $4 billion in investments.

- Subprime auto bonds are a big business for Wall Street, even as about a third of the underlying borrowers default.

- Investment-grade bonds have seen three straight weeks of inflows, according to Bank of America Corp., citing EPFR Global data.

- High demand for the latest raft of additional tier 1 bonds is an encouraging sign for banks that have a record $30 billion of calls next year.

- Manulife Investment Management is buying most of billionaire Michael Hintze’s CQS in a bid to expand the Canadian investment firm’s specialized fixed-income investment strategies.

- Kennedy Lewis Investment Management, an alternative-credit manager with about $14 billion under management, is exploring strategic options including an outright sale.

- After a federal law to curb surprise medical bills in the US triggered a handful of the year’s biggest bankruptcies, investors are eyeing corporate-debt piles for potential pain ahead.

- Lenders to bankrupt firms are increasingly demanding the use of a controversial contract clause that bolsters their investments in exchange for giving companies a chance at survival.

On the Move

- BNP Paribas SA made a number of senior appointments in its Americas banking business, including Mark Lynagh and Adnan Zuberi as co-heads of global capital markets and Erin Brown as head of leveraged finance.

- Nomura Asset Management has appointed Kapish Patel as co-portfolio manager on its corporate hybrid bond fund.

- First Eagle Alternative Credit recruited Larry Holzenthaler as managing director, portfolio manager and senior alternatives strategist.

- Eldridge Industries, the investment firm led by billionaire Todd Boehly, hired former Investcorp partner David Lee.

--With assistance from Claire Boston and Taryana Odayar.