The bond market has higher conviction that the Federal Reserve will leave interest rates steady this week after consumer price gains last month were in line with expectations.

Swaps traders lowered to about 10% the probability of an 11th straight increase in the US policy rate Wednesday, when Fed officials conclude a two-day meeting, from the current 5% to 5.25% range. While they also trimmed the odds of a quarter-point increase in July, that outcome is still judged to be likelier than not as inflation remains elevated.

“They have the option” this week “to skip,” Abby Joseph Cohen, former senior investment strategist at Goldman Sachs Group Inc., said on Bloomberg Television. “They have already done so much. I would vote for a wait and watch.”

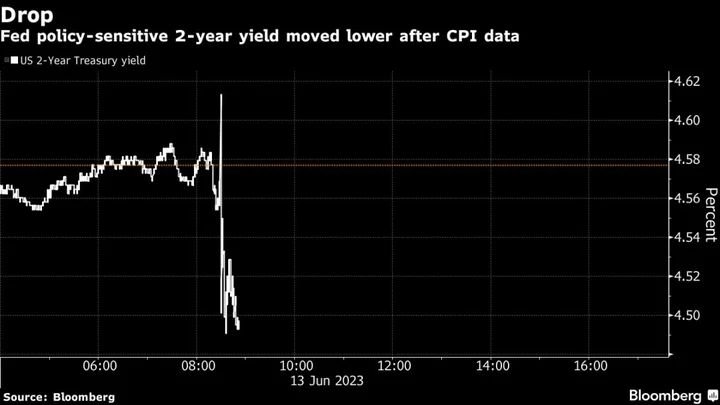

Treasuries yields initially fell before reversing course ahead of an auction of 30-year bonds.

The two-year yield dropped as much as 9 basis points to 4.49% before stabilizing and going on to plow higher as traders scaled back the likelihood the Fed will cut rates before the end of the year. The yield topped 4.64% for the first time since March.

What Bloomberg Economics says:

“May’s CPI likely won’t alter policymakers’ inclination to temporarily pause their rate-hike campaign at the June 13-14 FOMC meeting.

Still, price gains are easing so slowly that those expecting rate cuts later this year are likely to be disappointed.”

—Anna Wong, chief US economist

—Read full report, here

The 30-year rate briefly dipped before bouncing back, trading up 4 basis points at about 3.92% ahead of an $18 billion auction at 1 p.m. in New York.

The consumer price index fell to 4% from a year earlier, the lowest level since March 2021. Excluding housing and energy, service prices climbed 0.2% from a month earlier, more consistent with prepandemic trends, according to Bloomberg calculations. The gauge is closely watched for measuring the underlying price pressure.

The market’s reaction was exaggerated by the wagers on higher rates, said Ed Al-Hussainy, global rates strategist at Columbia Threadneedle.

The bond market “was a bit short into this meeting, and the knee-jerk reaction is a relief rally in rates,” he said. Still, “the underlying thesis playing out is that there is not much in this data to compel them to hike tomorrow.”

Interest rate swap contracts tied to the December meetings shows that traders betting the key borrowing costs will be 18 basis points lower from a peak, suggesting that traders are less convinced that the Fed will cut rates this year.

Elsewhere, UK’s government bonds sold off after a stronger-than-expected job report promoted investors to boost bets that the Bank of England would push the borrowing costs toward 6% by early next year. At 4.4%, the 10-year gilt yields are about 67 basis points above the US 10-year Treasuries, marking the biggest gap since 2009.

--With assistance from Ye Xie and Elizabeth Stanton.

(Updates market moves throughout and adds Bloomberg Economics comment.)