Hidden beneath convulsions in the global bond and currency market is an emerging sense of caution about the possibility the Bank of Japan may tweak yield-curve control policy at the end of July.

Benchmark Japanese bonds are proving resistant to a worldwide rally, sparked by a softening in US price and labor data. Ten-year swap rates, popular with international funds, have climbed well beyond the central bank’s ceiling for equivalent yields. And positioning in the yen points at further gains for the recently under-pressure currency, even if short-covering carry traders were responsible for igniting its July rebound.

That’s a sign that at least some market players think the BOJ may choose to reshape its policy of holding down 10-year yields to help boost an economy already showing signs of improved price and wage trends.

“Market moves heading into the July meeting are very important for the BOJ’s policy decision,” said Nobuyasu Atago, chief economist at Ichiyoshi Securities and a former BOJ official. “It’s clear that normalization of policy won’t happen anytime soon but the BOJ is keeping its options open for an adjustment of yield curve control.”

No Pressure

While there’s no sign of the pressure the Japanese bond market experienced at the beginning of 2023, 10-year yields have edged back toward the BOJ’s 0.5% line in the sand. The 10-year swap hit its highest since March on Wednesday, at 0.7%.

In a recent interview with local media, BOJ Deputy Governor Shinichi Uchida, a key policy architect for more than a decade, didn’t rule out tweaking YCC while indicating that raising the negative interest rate was out of question for a while.

“There is more speculation about this meeting than the last one,” wrote Societe Generale strategists Kit Juckes and Olivier Korber in a note to clients Wednesday. “What there isn’t, is as much push-back against speculation of a tweak to yield curve control, as there was ahead of the last meeting.”

The BOJ’s next policy decision comes at the end of a two-day meeting on July 28.

Economic Shift

One notable difference between the waves of speculation of policy change last year and this year is the strength of economic data in Japan.

Inflation remains higher than forecast while one measure of Japan’s wages, a key component in BOJ thinking, rose at the fastest since 1995, a government report showed last week.

The BOJ’s Tankan survey, one of the bank’s most closely watched reports, showed signs of a virtuous economic cycle emerging, with robust plans for business investment and hiring, and the first uptick in sentiment among manufacturers since 2021.

“There is a certain rationale for the BOJ to scrap YCC,” said Yoshimasa Maruyama, chief market economist at SMBC Nikko Securities. “That possibility should be in our minds for the July meeting.”

Japan Wage Growth Doubles Estimates, Feeding BOJ Speculation

Bond Buying

Still, not everyone is convinced.

An unwinding of short yen positions is a more plausible explanation for its strong rally in recent days than an uptick in policy tweak bets, according to Adam Cole, chief currency strategist at RBC Capital Markets.

“If we were seeing a significant shift in expectations for YCC this month, we would expect JGB yields to be trading at the top of the current YCC band,” Cole wrote this week. He also flagged the lack of aggressive bond buying to keep yields within the target range.

And BOJ Governor Kazuo Ueda’s remarks at the end of June, that more confidence was needed on the sustainability of price rises, caused some economists to lower their conviction on a policy shift.

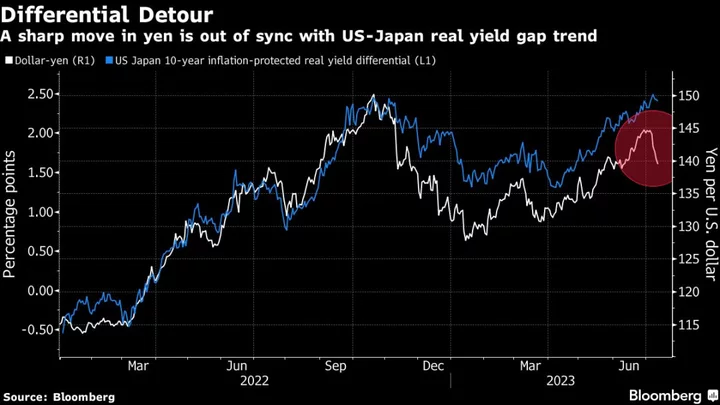

Signals from the options market suggest at least some traders are taking the threat of action more seriously. One-month risk-reversals for dollar-yen — a gauge of expected direction for the pair over that time frame — have slumped further below zero.

“Amongst analysts at least, July was already the favourite month for the BoJ to further relax YCC, though that may have subsequently slipped,” said Cole. “We would not rule out a further widening of the YCC band at this month’s meeting, nor a swift kneejerk move lower in dollar-yen if that happens.”