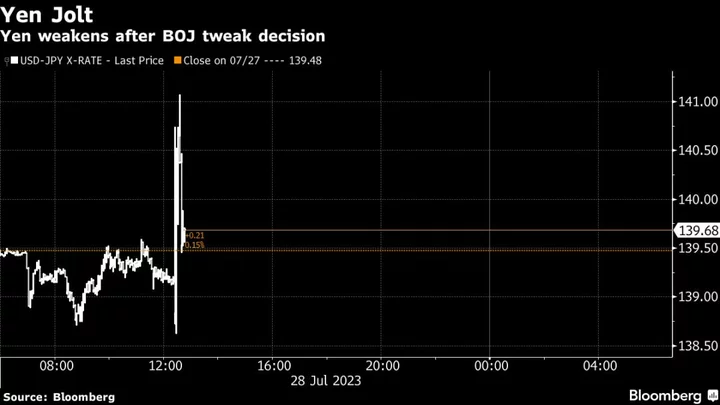

The Bank of Japan jolted financial markets by loosening its grip on bond yields in Governor Kazuo Ueda’s first surprise move since taking the helm, a step that will likely spur talk of potential policy normalization to come. The yen whipsawed to give back some of its earlier sharp gains against the dollar.

The BOJ kept the target for 10-year government bond yields at around 0% but said its 0.5% ceiling on yield movements was a reference point not a rigid limit as it sought to make its easing program more flexible. The bank left its short-term negative interest rate unchanged at -0.1%.

The continuation of the main policy settings will likely enable Ueda to argue that the new guidance on the band was a technical move aimed at improving the sustainability of its stimulus, rather than a step toward imminent policy normalization.

The yen dropped against the dollar following the decision, to pare earlier large gains following a Nikkei report that said the BOJ’s board would discuss whether to tweak yield curve control policy to let long-term interest rates rise above its 0.5% cap by “a certain degree.”

The yield on 10-year government debt rose to 0.53% after having earlier breached 0.5% following the Nikkei report.

Only 18% of 50 economists polled by Bloomberg were expecting a YCC tweak at this meeting, though about half foresaw such a move no later than October. In addition, there was a widespread view that any change to the program would have to come as a surprise, as any foreshadowing might trigger a massive bond sell-off, complicating the move.

In the end, Ueda probably chose to rid the board of a major headache at an early stage in his tenure, taking advantage of relative calm in the market, as investors mostly stopped trying to test the BOJ’s resolve to defend its targeted ranges in recent months. The bank last surprised investors in December, when it doubled its yield cap in a move that now appears to have been insufficient to allay concerns at the bank over the side effects of the program.

A growing consensus that the US and European central banks are nearing an end to their tightening cycles has eased upward pressure on global bond yields, a development that offered a window of opportunity for the BOJ to adjust YCC with a lower risk of a surge in Japanese yields.

The European Central Bank raised rates Thursday, a day after the Federal Reserve also hiked. While Fed Chairman Jerome Powell held out the possibility of further action, pricing in the swaps market indicates a widespread belief that any subsequent move would be the last.

Japan’s stocks hit a 33-year high earlier this month and the yen has stayed around 140, limiting adverse impacts from the yield control adjustment.

Ueda will hold a press briefing at 3:30 pm local time.

(Adds more details from statement and outlook)