Bitcoin developer Blockstream Corp. is betting that the world’s most valuable cryptocurrency is poised for a massive rebound, and is buying up Bitcoin mining rigs so that it can sell them for a profit later should the prediction hold.

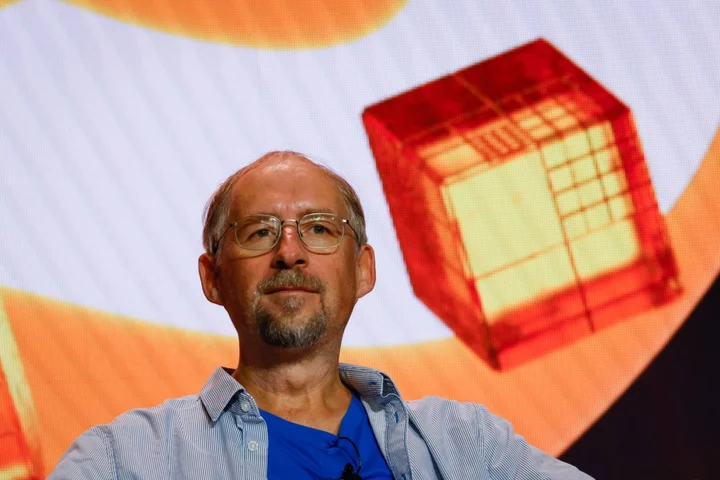

Montreal-based Blockstream was one of the earliest Bitcoin infrastructure companies, conceived in 2014 by CEO and co-founder Adam Back, among the industry insiders thought to be Satoshi Nakamoto, the pseudonymous creator of Bitcoin — speculation dispelled by Back.

Now, the company is looking to capitalize on Bitcoin’s looming software upgrade — rather ominously dubbed the ‘halving’ — which it expects will spur a rally in the digital asset’s price, in turn pushing up the price of the specialized computers, or application-specific integrated circuit machines, used by miners to generate Bitcoins.

“We made quite a bit of money buying and selling miners, and then we’re looking at the market and we see that there’s really a financial opportunity here,” Blockstream’s CEO Adam Back said in an interview.

While Bitcoin and ASIC market prices have shown a high correlation, ASIC prices tend to undershoot Bitcoin’s value in bear markets and overshoot in bull markets, suggesting a potential upside when denominated in Bitcoin, the firm said in a statement Tuesday.

A glut of mining machines flooded the market last year as Bitcoin’s price plummeted, while major crypto lenders like New York Digital Investment Group have also liquidated machine-backed loans. After rebounding about 70% in the first quarter, the price of Bitcoin has stalled at around $30,000 for months. Bitcoin reached an all-time high of almost $69,000 in November 2021.

But Blockstream spies a window of opportunity as Bitcoin’s halving approaches. Scheduled to take place in early 2024, the once-every-four-years event cuts in half the amount of coins that miners can earn for generating Bitcoin, helping to maintain the token’s value by reducing supply.

Since those rewards are the main source of income for miners, the upgrade is likely to prompt an arms race to buy new machines to better compete for the limited supply of tokens. Blockstream said it is aiming to raise $5 million through a newly launched investment vehicle so that it can buy, warehouse and then sell ASICs into the market at a premium should Bitcoin’s price rally in the run up to the halving. The firm expects that the initial $5 million fundraising effort will be the first of more tranches as demand from investors increases.

“We think there’s a huge price correction coming where we see the ASICs coming back up to where the Bitcoin price would be when the capacity is on a market,” said James Macedonio, global head of mining sales and business development at Blockstream.

The firm’s investment vehicle, called The Blockstream ASIC (BASIC) Note, is issuing its Series 1 notes at $115,000 each, according to Tuesday’s statement. The securities will be offered on Blockstream’s Liquid Network, with the first tranche being made available today.

The fund raise follows Blockstream’s $125 million convertible note and secured loan financing in January to expand its Bitcoin mining co-location services, whereby the firm hosts and operates mining hardware at data centers on behalf of clients. The firm also raised $210 million on a valuation of $3.2 billion in 2021 to advance its mining products and services, and has previously received backing from LinkedIn co-founder Reid Hoffman.

Bitcoin mining is an energy-intensive process in which miners use specialized computers to validate Bitcoin transactions on the blockchain in return for token rewards. A single Bitcoin mining rig can cost thousands of dollars, which means large-scale miners often raise funds to purchase the machines by selling shares in their businesses or securing debt financing. Lenders also use the mining machines as collateral on loans.

The value of the mining machines tends to depreciate significantly over time since manufacturers like Bitmain and MicroBT roll out newer and more energy-efficient models every few years. Miners typically upgrade their fleets of mining machines between those periods, as they compete against each other to earn Bitcoin rewards.

(Adds in the eighth paragraph that Blockstream anticipates raising additional funds after the initial tranche.)