Some of the world’s biggest fund managers are piling in to a quirky Chilean business model that offers guaranteed long-term prices for power produced by tiny renewable plants.

BlackRock Inc. and Brookfield Corp. are among firms buying portfolios of small generators known as PMGDs for their Spanish initials. The mainly solar farms give environment-focused investors access to stable prices in a market characterized by renewable supply gluts that can mean large producers get nothing for their spot sales at times.

The money flowing in to PMGDs is part of a clean-energy boom in Chile, with the South American nation’s abundance of wind and sunshine helping it top BloombergNEF’s ranking of most attractive emerging markets for renewable investments. But like other markets, transmission investments haven’t kept up with the generation boom. PMGDs afford some protection from the ensuing bottlenecks and price distortions.

“Foreign interest in Chile’s renewable energy projects through these small units is on the rise as they have demonstrated to be stable and leverageable,” said Jonathan Huckaby, partner at Hudson Bankers, one of the advisors behind the most recent portfolio purchase from BlackRock.

BlackRock expects to reach 450 megawatts of capacity at small generators by 2024. Its most recent acquisition included 11 solar projects totaling about 100 megawatts from D’E Capital and another 100 megawatts in 15 projects from Renewable Resources Group. Brookfield is also looking to step up investments, said a person with knowledge, who isn’t authorized to speak publicly.

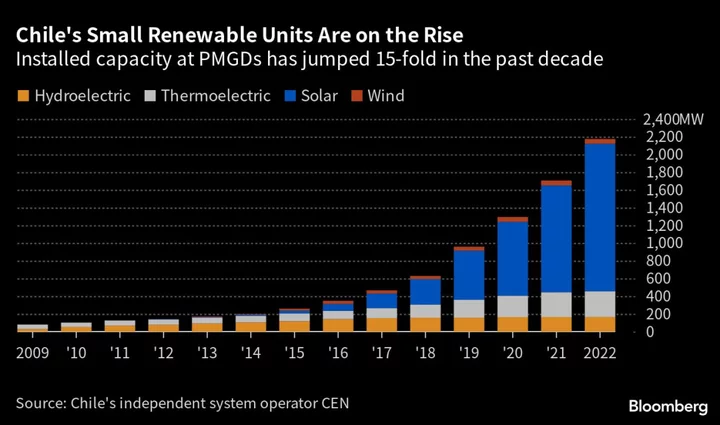

In total, PMGD-type plants in Chile had installed capacity of 2,175 megawatts at end-2022, or about 14% of the grid, according to independent system coordinator CEN. That’s up from just 150 megawatts a decade ago. If all approved projects were to go ahead, capacity would double by end-2023, National Energy Commission data show.

Projects of 9 megawatts or less — somewhere between residential and industrial scale — qualify for a price stabilization mechanism. By being located closer to consumption centers, PMGDs also avoid much of the transmission issues.

Read More: Chile Resists Renewable Rescue as Boom Threatens to Turn to Bust

Not everyone’s a fan of offering protection from spot-market price swings. CEN says such incentives exacerbate surpluses.

Price stabilization “eliminates the economic signal of zero marginal costs in periods of excess injection of photo-voltaic solar plants, which would maintain the incentive to install more projects of the same technology,” according to a CEN report.

About 80% of the small units in operation are easy-to-build solar plants. Other big names investing in the space include Sonnedix and Germany’s Blue Elephant Energy.