Bitcoin has had a sleepy summer. This week, it was shaken awake.

For the past several months, the hallmark volatility that previously attracted hordes of investors to the world’s largest cryptocurrency has been absent, with the rate of its swings reaching its lowest point since 2016.

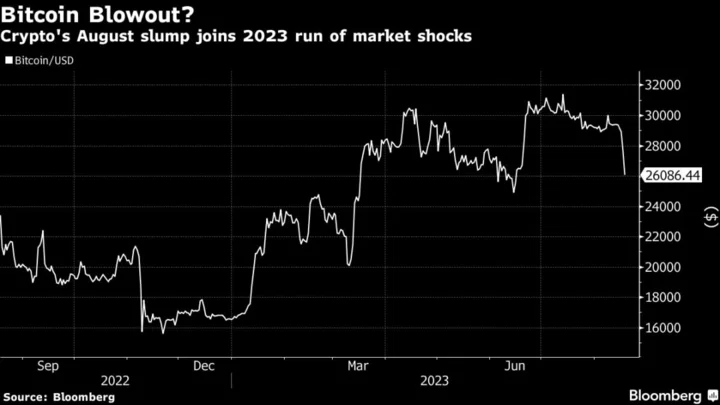

That lull snapped Thursday, when Bitcoin plunged more than 8% in the space of a few hours to a two-month low of $25,314 late in the New York day. The slump sparked a broad decline across all of crypto, leading to more than $1 billion in liquidations and putting Bitcoin on pace for its worst week since November and crypto exchange FTX’s collapse.

The carnage — fueled by the prospect of prolonged high interest rates and exacerbated by thin crypto trading — was a reminder of the various threats that continue to stalk digital assets, from hostile regulators to a broader rout in risk assets. And even as Bitcoin has recovered smartly from last year’s lows, many investors are still sitting out, depriving the market of the breadth and depth that are key ingredients for a sustained bull run.

Read more: Bitcoin Volatility Vanishes Amid ‘Extreme Apathy and Exhaustion’

“There are still significant amounts of macro uncertainty keeping investors away, and liquidity is still thin,” said Noelle Acheson, author of the “Crypto Is Macro Now” newsletter and former head of market insights at Genesis Trading. “Bottom line, there’s not yet enough conviction.”

Thursday’s activity marked another entry in an emerging trendline for Bitcoin in 2023, with the token having already crashed to two similar low points in January and March. But every sharp decline this year has been followed by recovery, said FRNT Financial’s Stephane Oullette.

“The next few days should give more clues to whether the selloff will continue and we’ll see a reversal of this year’s trend,” Oullette said in an email on Friday. Signs that Bitcoin is making a major divergence would be if the token were to make a decisive break below the $25,000 mark, he added, or conversely, a sustained push beyond $30,000. Its high for the year was $31,818 in July.

Part of the reason behind this week’s plunge was the market’s outsize exposure to larger trades. The last four months have had the lowest average daily volume of spot crypto transactions since October 2020, according to Riyad Carey, a research analyst for blockchain data firm Kaiko. At that time, Bitcoin was worth around $10,000, while the second most popular cryptoasset Ether, now at $1,670, was valued at $350.

The sector is also overly reliant on narrative to prop up prices, with hype around crypto’s next buzzy project or a Wall Street firm buying cryptocurrencies among the things that spur on investors. A Wall Street Journal report that Elon Musk’s SpaceX had sold Bitcoin holdings worsened Thursday’s decline.

But the narrative is unlikely to improve when these days, many of the biggest announcements to rock the world of digital assets come either from regulators in Washington or judges in the courtroom. The hangover from 2022’s run of bankruptcies and fraud scandals continue to play out on the world stage, dampening optimism on crypto’s recovery.

Just this week, former FTX co-founder and alleged fraudster Sam Bankman-Fried was escorted to a Brooklyn penitentiary after his bail deal was revoked by a judge. Bankman-Fried has pleaded not guilty to the multiple criminal charges he faces.

Recent price declines can be partly attributed to US enforcement actions against crypto exchanges, CoinShares’s James Butterfill said in a blog post on Friday, adding that a recent survey saw fund managers rank regulatory decisions as their key concern. The lingering threat of further lawsuits or penalties haunts the market, leaving investors wary of the safety of some of crypto’s top venues.

Despite this, Bitcoin has displayed a general resilience over the last few months when compared to global risk assets. Post crash, it’s still up 58.1% so far in 2023 — far higher than the S&P 500’s 13.6% gain. And while Bitcoin is likely to experience further downside if monetary conditions continue to deteriorate, Bloomberg Intelligence’s Jamie Douglas Coutts reckons that hype around a potential US spot crypto ETF may help it maintain that value.

Read more: SEC Set to Greenlight Ether-Futures ETFs in Crypto Industry Win

BlackRock Inc.’s surprise filing in mid-June for a Bitcoin ETF prompted a flurry of firms to follow suit and led to a mini-rally as investors bet that approval of the funds would spur a wave of fresh buying. And it’s not just Bitcoin. A Bloomberg report late Thursday that the US Securities and Exchange Commission is poised to allow the first ETF based on Ether futures helped to reverse some of the token’s initial plunge — and a confirmed approval will likely cause an Ether bounce that drives up other tokens with it, Acheson said.

Global Concerns

Still, absent a catalyst like an ETF approval, the market is likely to drift. And unfortunately for traders who thrive on price swings, Friday’s sharp spike in price activity across Bitcoin and other cryptocurrencies is likely to be short-lived, at least until liquidity improves among both digital assets and more traditional markets.

As central banks continue to raise or maintain high interest rates, the appeal of traditional financial investments like short-dated US Treasuries and other bonds have drawn focus away from crypto bets as investors chase a risk-off attitude.

“Global macro is going to continue to weigh in,” said Fadi Aboualfa, head of research at crypto custodian Copper Technologies Ltd.

Some crypto bulls say the sector could benefit from situations such as China’s deteriorating property sector, which has become a primary concern from a macro perspective. Stimulus measures implemented by the government have so far failed to provide enough economic relief, and Bitcoin’s positioning as an alternative financial system has some believing it might benefit from any shocks. “While we consider a full financial meltdown unlikely, should it transpire, it might bolster Bitcoin, especially if the repercussions permeate the broader financial sector,” said Butterfill.

Ultimately though, what’s bad for the global economy is likely also bad for crypto.

“If the stock market drops accelerate, crypto is also likely to suffer in sympathy as investors choose to lock in profits with whatever they can and sit in high-yielding cash until the dust settles,” said Acheson. “The dust will settle, however, most likely sooner in the crypto market than in the stock market as investors recalibrate the relative risk of each asset group.”

--With assistance from Philip Lagerkranser.