One closely-watched measure of Bitcoin mining revenue is hovering around a record low as the price of the largest digital asset stagnates and competition heats up.

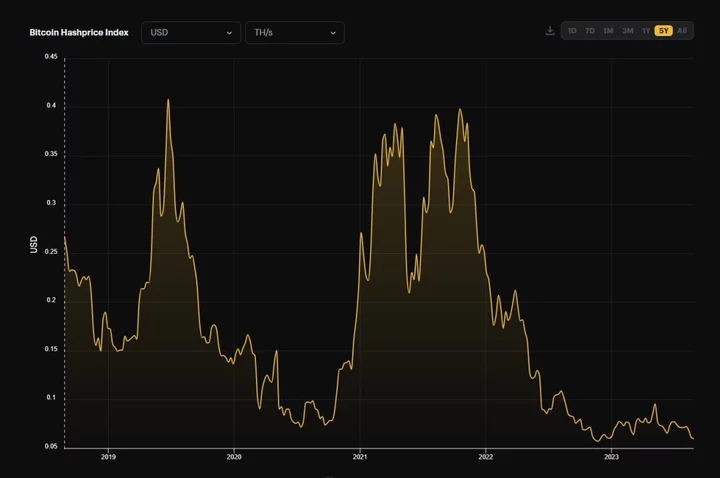

The so-called hashprice fell to $0.06 for a unit of computing power per day on Sunday, according to Hashrate Index data. That is close to the record low seen around late 2022 when major publicly-traded mining companies warned of a liquidity crunch and some declared bankruptcy.

The miners now have more breathing room despite the drop in revenue as they have raised large amounts of capital from selling shares and minted coins earlier this year with a rebound in the price. But a sustained retreat in the digital asset and increasing competition in the industry can wreck havoc on Bitcoin miners.

Bitcoin mining is an energy-intensive process in which firms use expensive specialized computers to validate records of transactions on the blockchain and earn rewards in the form of the token. This is done by thousands of the computers, or Bitcoin mining rigs, stacked on top of each other in data centers that use high amounts of electricity.

The largest cryptocurrency was little changed around $26,000 as of 11:26 a.m. in New York, and had traded at an average price at around $26,200 this year. Bitcoin fell 64% in 2022, finishing the year at $16,500. The price reached an all-time high of almost $69,000 in late 2021.

The mining difficulty, a gauge of computing power used to mine Bitcoin, set a record high last week, according to btc.com data. That indicates miners are churning out more computing power than ever to compete for a fixed amount of Bitcoin rewards issued by the blockchain to the miners, which is their main revenue source.

Miners are scaling up regardless of the current prices in part due to an upcoming Bitcoin code update called the ‘halving’. The update cuts the Bitcoin rewards to miners in half every four years and maintain the coin’s 21 million supply cap. The next halving is set to take place in 2024. The mining companies have to increase their computing power and stay competitive to fight for even less rewards after the event.