Just when markets appear to be moving past the months-long drama around the US debt ceiling, holders of risky assets such as cryptocurrencies are likely facing a fresh challenge while the Treasury looks to rebuild its depleted cash balance with an estimated $1 trillion Treasury-bill deluge.

“The impending reserve drawdown, due to the [Treasury General Account] rebuild, may prove to be a headwind,” Citi Research strategists including Alex Saunders wrote in a note.

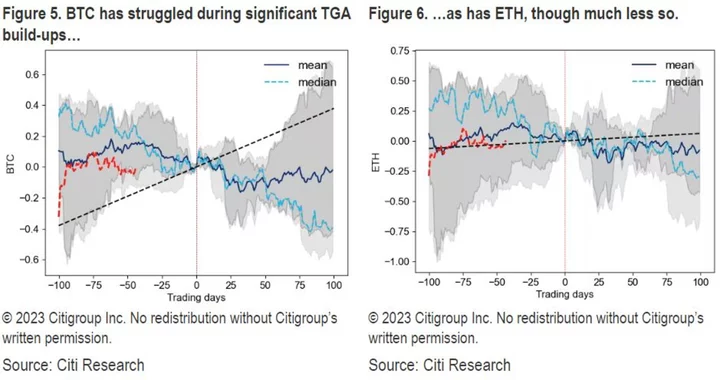

Citi analyzed the performance of risky assets during drawdowns and found that they were vulnerable to higher volatility and weaker returns. As such, the near-term outlook doesn’t seem too rosy for Bitcoin and Ether. “Both coins average negative returns in these scenarios, and BTC has significantly underperformed in the median case,” the strategists wrote Thursday.

The TGA, which keeps money for the Treasury, ballooned during the pandemic. It expanded again last year and is now about as low as it has ever been. Treasury, as a result, will need to replenish its dwindling cash buffer to maintain its ability to pay its obligations through bill sales, estimated at well over $1 trillion by the end of the third quarter. This supply burst may drain liquidity from the banking sector and raise short-term funding rates against an economy many say is likely to fall into recession.

This doesn’t bode well for digital-asset investors, who were just recovering from fears of a no-deal scenario for the US debt ceiling. While Bitcoin edged higher on Friday, it’s still hovering around the $27,000-mark that it has failed to break away from for several weeks.

“Crypto markets were not immune to fears of the US defaulting on its debt, selling off on negative developments and rallying on headlines suggesting progress,” the strategists said. They added that crypto has typically “fared well” amid issues concerning traditional financial institutions, citing the banking turmoil in March, a period in which Bitcoin outperformed. But perhaps risks of an institution such as the US government defaulting “doesn’t paint a favorable outlook for decentralized digital assets.”

To illustrate, the strategists used the Cboe Volatility Index, or VIX, as an indicator of the market’s fear to gauge whether a resolution would be passed before hitting the ceiling. And whenever equity market concerns were eased, that’s when Bitcoin outperformed.

“While in theory the potential default of an institution as impactful as the US government would bode well for decentralized technologies and systems, this may not currently be the case given that the crypto industry is still in its infancy and regulation has yet to be well-defined,” they wrote. “Another theory is that not raising the debt ceiling would lead to reduced US government debt and a lower fiscal deficit, and provide more credibility to fiat, particularly the dollar.”

On Friday, the Senate passed legislation to suspend the US debt ceiling and impose restraints on government spending through the 2024 election. The measure now goes to President Joe Biden, who forged the deal with House Speaker Kevin McCarthy and plans to sign it just days ahead of a looming US default.

Year-to-date, Bitcoin has rebounded some 60% after starting the year at around $16,500. Such optimism comes after 2022’s 64% drop, its second-worst year in its history. It rose about 1% to $27,178 as of 3:32 p.m. in New York, and is marginally higher from last Friday.

Bitcoin’s support hovers around $26,500, said Fiona Cincotta, senior market analyst at City Index, adding that a break below $25,000 could mean a deeper sell-off.

“The problem is the macro backdrop, which is relatively uncertain going forward with recessionary fears,” she said. “I think what will be looking for to make Bitcoin shine is a nice dovish pivot from the Federal Reserve. That might be the tide where we will see another decent leg higher.”

Range-bound trading has been Bitcoin’s defining characteristic of late, with its 30-day volatility reigning low at 1.8%, firmly staying firm within its two-month-long trading range. Despite growing short-term volatility, options implied volatility trended lower over the past week, according to K33’s Bendik Schei and Vetle Lunde. Even so, Bitcoin exchange-traded products continued to see steady outflows while Bitcoin volumes — spot and futures — are trending lower.