The coders who maintain Bitcoin’s blockchain are clashing over whether to stamp out the meme tokens swarming the network.

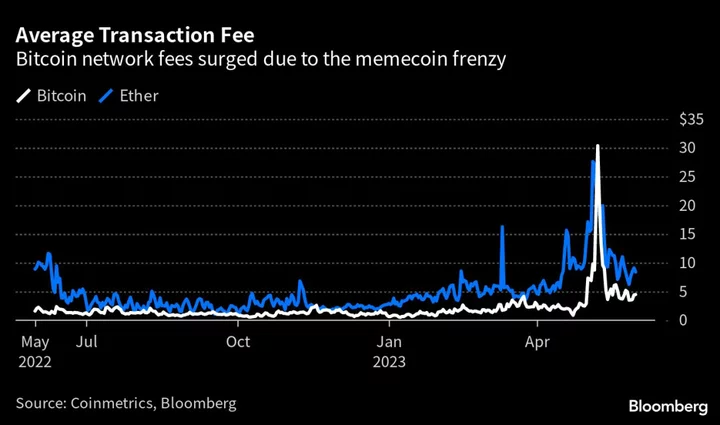

A torrent of speculative coins led to a record number of transactions and an 11-fold spike in processing fees on the blockchain in May, creating a logjam and forcing the Binance exchange to temporarily halt Bitcoin withdrawals.

The tumult has since eased, but some crypto purists fret that future frenzied trading of memecoins like the frog-themed Pepe will again snarl the network and disrupt Bitcoin’s use for payments and as a store of value. They advocate deploying software to block the transactions — a kind of spam filter.

“I do think the system is being abused,” said Bitcoin developer Ali Sherief. “Bitcoin was never intended to serve as a base layer for meme tokens.”

In an earlier email to the largest digital asset’s developer group, Sherief wrote that “worthless tokens threaten the smooth and normal use of the Bitcoin network as a peer-to-peer digital currency.”

Others defend the software innovation, called Ordinals, that allows Bitcoin’s blockchain to host large numbers of meme coins and nonfungible tokens — digital collectibles — for the first time, arguing it can have wider applications.

Developer Casey Rodarmor created Ordinals to enable users to inscribe digital content like videos, images and text on satoshis, the smallest unit of Bitcoin. There are 100 million satoshis in one Bitcoin.

Rodarmor’s innovation took off this year and was seized on by pseudonymous blockchain analyst Domo to develop the Bitcoin Request for Comment — or BRC-20 — standard, which led to the explosion of memecoins.

There are now about 25,000 meme tokens on the Bitcoin blockchain with a market value of roughly $475 million, according to website brc-20.io. The figure had soared past $1 billion in early May.

Jameson Lopp, co-founder of crypto storage solutions provider Casa, said the Bitcoin network is meant to be an “auction market for the block space” — the place where data is stored — and Ordinals merely stoked demand for it.

As a result, viewing the memecoins as a denial-of-service attack is “like saying any form of auction is a denial of service, and whoever wins is denying all of the losers of the auction,” Lopp said.

At one point last month meme tokens and NFTs accounted for 65% of the transactions on the Bitcoin blockchain. The proportion has dropped back but remains elevated. The average fee per transaction began April at $2.80, hit $30 in early May and cooled to $4 by the end of the month, Coinmetrics data show.

The jump in fees has been a boon for miners, the operators of the computer rigs underpinning Bitcoin, who have raked in $45 million from Ordinals-related activity, according to figures from Dune Analytics.

Read more: Memecoin Mania, NFTs Bring ‘Seismic Shift’ for Bitcoin Mining

For veteran Bitcoin developer Luke Dashjr, Ordinals transactions are like spam and should be kept off Bitcoin’s blockchain. He’s even created a program, Ordisrespector, to enable computer nodes on the network to do that.

“Action should have been taken months ago,” Dashjr wrote in a developer group. “Spam filtration has been a standard part of Bitcoin Core since day 1.”

Given that no single person or entity controls the Bitcoin network, nobody knows if sustained action against memecoins and NFTs will emerge over time. Another possibility is that some people could decide to create a version of Bitcoin — called a hard fork — that won’t support Ordinals.

“I don’t see a critical mass of people coming together on a single alternative to Bitcoin which is incompatible with BRC-20 tokens,” said Andrew Poelstra, director of research at Blockstream.

Amid the controversy, the key takeaways from the Ordinals phenomenon include the ability to use the Bitcoin network in novel ways and the need to scale up its transaction capacity to avoid future traffic jams.

The true value of Ordinals is the capacity to store arbitrary data on the Bitcoin network, according to Sami Kassab, a research analyst at Messari.

“Whether it’s artists, activists or even governments that end up leveraging this storage space, it’s clear that the demand and cost for it will likely rise in the future,” Kassab said.