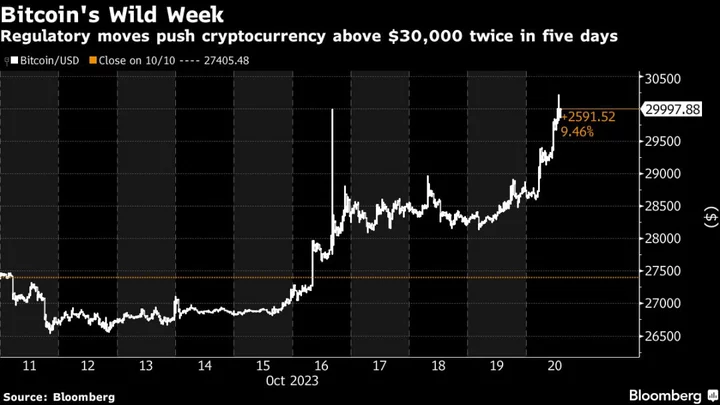

Bitcoin topped $30,000 for the second time this week on growing expectations that another favorable court action raises the likelihood than an exchange-traded fund holding the cryptocurrency will finally be approved.

A DC court is expected to issue a mandate Friday that could make effective an August opinion that went in favor of Grayscale Investments LLC, which had sued the US Securities and Exchange Commission as it looked to convert its Bitcoin trust (GBTC) into an ETF. It’s the next step in the process after the SEC last week opted against appealing the previous ruling, which it had lost.

The expected decision follows the SEC’s retreat late Thursday from a lawsuit against two Ripple Labs executives.

Bitcoin rose as much as 5.2% to $30,223 as of 7:30 a.m. in New York, taking it back to price levels last seen in August. XRP, the token affiliated with Ripple Labs, rose for a second day, increasing 2.7% to around 52 cents.

The move in Bitcoin, which accounts for about half the crypto sector’s market value, helped to spur a broader rally in smaller tokens. Ether was trading up 3.2%, while so-called altcoins like Solana’s SOL and Polygon’s MATIC rose 7.8% and 4.4% respectively.

The SEC asked a federal judge on Thursday to dismiss its case against Ripple co-founder Christian Larsen and chief executive Bradley Garlinghouse, ending a lawsuit that had accused the pair of misleading investors in the XRP cryptocurrency by selling more than $1 billion of the tokens without registering them. The move was received positively by investors as a sign that the watchdog may soon acquiesce on a much larger matter — whether it has the right to regulate cryptoassets as securities at all.

Read more: SEC Asks Judge to Dismiss Charges Against Ripple Executives (3)

By abandoning the lawsuit, the SEC is free to focus on appealing a July ruling that saw US District Judge Analisa Torres say XRP wasn’t a security when sold to the general public on crypto exchanges. An analysis by Bloomberg Intelligence on Thursday suggested that Ripple still has a 70% likelihood of prevailing over the SEC in the event of an appeal, though such a filing may not arrive until mid-to-late 2024.

“Though beneficial for the crypto industry, the ruling in SEC v. Ripple was a somewhat mixed outcome for Ripple,” said Elliott Z. Stein, a senior litigation analyst for Bloomberg Intelligence. “On the one hand, its XRP token can trade freely on secondary markets, for now. On the other, Ripple may have to disgorge up to $729 million in unregistered institutional sales and could be subject to penalties. The next phase of the case will determine remedies.”

Bitcoin’s earlier move above $30,000 on Monday came after a media report falsely suggested the SEC had approved its first exchange-traded fund tied directly to the price of Bitcoin — a sign of just how eager crypto investors are to see such a product make it over the line.

“Institutional demand for a spot Bitcoin ETF is stronger than ever before. For many institutions, it is a matter of when—not if—the SEC will approve a spot Bitcoin ETF,” Diogo Mónica, co-founder and president of crypto bank Anchorage Digital, said in an email on Thursday. “At the end of the day, a spot Bitcoin ETF would bring us closer to a future where all major institutions can participate directly in the digital asset class.”