Key Binance executives who have been helping the world’s biggest cryptocurrency exchange navigate a widening regulatory crisis including US allegations of fraud are leaving the company along with many of its US employees, according to people familiar with the matter.

Patrick Hillmann, chief strategy officer at the company since late 2021, is leaving, he confirmed on Twitter, saying he was “doing so on good terms.” Steven Christie, senior vice president for compliance, and Hon Ng, Binance’s general counsel, have also left, a person familiar with the matter said. Eleanor Hughes, currently Binance’s head of legal for APAC and MENA, will become the new general counsel, said the the person, who asked not to be named discussing private information. Noah Perlman, who joined Binance in February from Gemini Trust Co. to be chief compliance officer, remains at the company.

Binance employed nearly 600 employees in the US, according to LinkedIn. During midyear performance reviews in June, various of these staffers were asked whether they would be willing to relocate and some of those who declined were let go, the person familiar with the matter said. Binance didn’t respond to a request for comment on any of the departures or information.

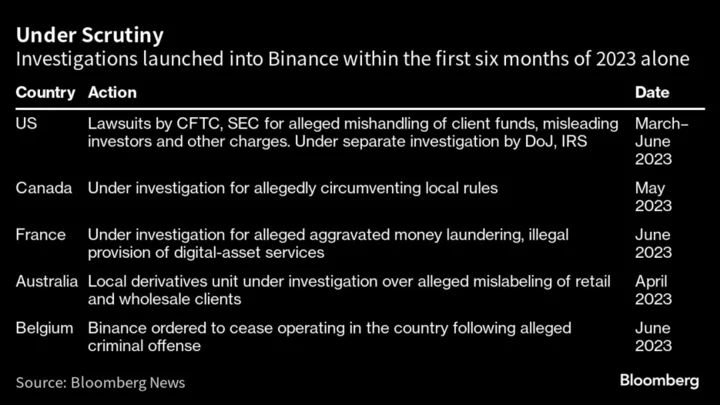

Binance faces a web of probes around the world. The US Securities & Exchange Commission last month accused Binance and its founder Changpeng “CZ” Zhao of mishandling customer funds, misleading investors and regulators, and breaking securities rules. Binance has called the SEC action “disappointing” and said that it intends to defend its platform “vigorously.” Zhao and Binance also face a lawsuit from the Commodity Futures Trading Commission. The US Justice Department has also been investigating the company, Bloomberg News has reported.

On Tuesday, the Australian Securities and Investments Commission conducted searches at several Binance Australia locations on Tuesday, people with knowledge of the matter said, asking not to be identified discussing private information. The action was part of an investigation into its now-defunct local derivatives business, according to the people. It has also faced regulatory blowback in recent weeks in France and Belgium.

Regulatory crackdowns on Binance from Australia to Europe and the US are becoming a drag on its business. The heightened scrutiny has also prompted some banking partners to drop Binance, limiting clients’ ability to deposit and withdraw fiat money on the exchange. Binance’s market share has slipped as the crisis has deepened: The exchange’s share of non-derivatives trading volume declined for the fourth consecutive month in June to its lowest since last August, according to a report from researcher CCData.

(Adds more details.)