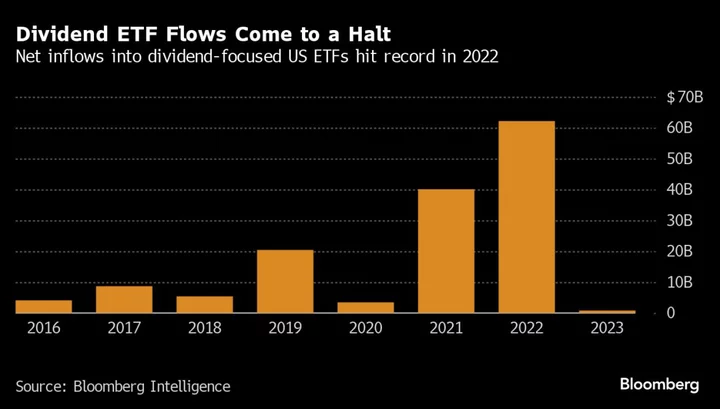

Reeling from a bear market last year, beaten-up investors decided to send more than $60 billion to exchange-traded funds focusing on dividends.

Eleven months later, the trade is misfiring.

Rather than give shelter in a stormy season, the largest dividend ETFs have been left behind by a tech-obsessed market whose biggest proxies have surged 15% or more. At the bottom of the leader board is the $18 billion iShares Select Dividend ETF (ticker DVY), down 5.4% on a total return basis after all-in bets on utilities and financial stocks fizzled.

It’s the latest lesson on the dangers of market timing. Investors wanted exposure to companies with a history of paying out profits as a precaution amid the Federal Reserve’s most aggressive tightening cycle in 40 years. Instead they were saddled with underperforming companies that proved especially vulnerable when yields shot higher.

The casualty list includes the $20 billion SPDR S&P Dividend ETF, down 3% (SDY) on a total-return basis, the Schwab US Dividend ETF (SCHD), off 2.4% and Vanguard’s High Dividend Yield ETF (VYM), which is mostly flat for the year. Funds that have eked out gains have mostly posted small ones, like the Invesco Dividend Achievers ETF (PFM) which is up 6.6%, the ProShares S&P 500 Dividend Aristocrats ETF (NOBL) which is up 2.3% and the Vanguard Dividend Appreciation ETF (VIG), which is up 9.6% and focuses on mid and large-cap stocks.

Invesco’s Nick Kalivas said that PFM’s lagging performance is linked to its underweight to the so-called Magnificent Seven and overweight to less “growthy” technology names like Oracle Corp., Cisco Systems Inc. and IBM Corp. ProShares said that the companies in NOBL delivered “fundamental performance,” delivering earnings growth on average, even as overall earnings for the S&P 500 shrunk this year. State Street’s Matt Bartolini noted that dividend strategies have a “value bias” and 2023 was a “growth market.”

Vanguard and BlackRock declined to comment.

“With a small handful of largely growth-oriented stocks dominating the market’s performance, 2023 was a challenging environment for dividend-paying, value securities, especially with the compelling case for fixed income in a higher rate environment,” said D.J. Tierney, senior investment portfolio strategist at Schwab Asset Management, which houses SCHD.

For the most part, the flood of cash to dividend strategies meant investors got pushed into the likes of value stock and out of Big Tech megacaps, which have driven the market gains. In the case of SDY, half of the fund is concentrated in three sectors that have declined this year: consumer staples, utilities and health care. Its top holding, manufacturer 3M Co, has plunged 15%. Compare that to VIG, which holds nearly one quarter of the fund in information tech, a rare feature for dividend funds.

The idea dividends enhance stock returns is a selling point of brokers that is itself subject to dissent. Any payout they provide shareholders is effectively offset by mechanical declines in the price of the stock — the so-called ex-dividend effect — leaving returns mostly a function of stock picking. This year has been a particularly rough one for stocks valued for their cash flows because of increases in bond yields, which represent competition for investor dollars.

Adam Phillips, a portfolio manager at Torrance, California-based RIA EP Wealth Advisors, says he’s gotten numerous emails and calls over the past year from fund issuers pitching dividend-paying strategies.

“We have not taken the bait,” he said, who noted growth stocks “aren’t going anywhere,” particularly if interest rates have peaked.

He’s not the only one avoiding the sector. Just $786 million has flowed into dividend ETFs so far this year, the smallest haul since 2006, according to Bloomberg Intelligence.

To be sure, the ability to consistently pay a dividend over a long time-span is often a hallmark of a company’s stability. Take the S&P 500 Dividend Aristocrats index, which comprises S&P 500 members that have raised dividends for at least 25 consecutive years. While trailing its namesake benchmark, it’s beaten nearly every US active manager over the past decade.

“Raising your dividend for 25 plus years is no easy feat,” said Rupert Watts, head of factors and dividend indices at S&P Dow Jones Indices. “These are high quality companies.”

Versus the S&P 500’s total return, however, that index has unperformed on a six-month, one-year, 5-year and 10-year intervals.

Read more: Income-Hunting Investors Are Fueling a $50 Billion ETF Bonanza

Sam Huszczo, founder of RIA SGH Wealth Management, is constantly pushing back against his clients’ requests for dividend strategies. His average client is 65 years old and finds comfort in the cash flow dividend strategies offer.

“It’s the perception that, well at least if I get 3% in a dividend ever year, I’m getting something out of this thing,” said Huszczo. “But that’s too short-sighted of a perspective, because if the price appreciation is worse because you’re getting something that has no ability to grow, you’re not getting the full value of of those stocks compared to other places in the market.”

Meanwhile, bonds are offering some of the highest interest rates in decades, presenting investors with a more reliable stream of income than dividend funds. Ultra-short bond ETFs have pulled in $30 billion this year after hauling a record $42 billion in 2022.