The US ethanol industry, already under pressure from rising corn costs and weak gasoline demand, saw its long-term outlook dampen further after the federal government’s surprise pullback in support for the plant-based fuel.

The Environmental Protection Agency blending mandates issued Wednesday limit the amount of conventional ethanol that can be used to fulfill quotas in 2024 and 2025 to 15 billion gallons, a cut from the target of 15.25 billion gallons proposed earlier. With rising input costs already threatening to squeeze margins that had just started to improve, the trimmed quotas are a concerning development for ethanol producers fighting for a bigger share of American gas tanks.

The EPA’s move is “inexplicable and unwarranted,” said Renewable Fuels Association Chief Executive Officer Geoff Cooper.

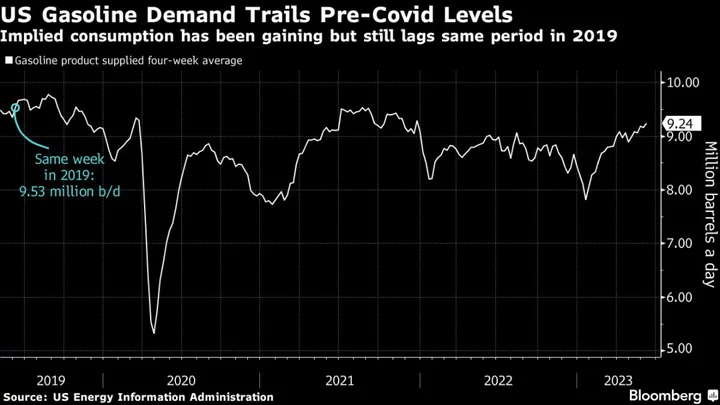

The latest blending requirements come at a time when gasoline usage is still lagging pre-pandemic levels. Demand is about 3% below the same period in 2019, according to recent government data, and a growing market for electric vehicles only threatens to make things worse. It’s not just ethanol that’s reeling: Critics say the latest biofuel-blending requirements also hinder the Biden administration’s own clean energy and climate goals.

“Higher blending targets would enable fuels such as E15 and E85 to quickly displace carbon pollution from gasoline, but EPA’s proposal will rein in those opportunities,” said American Coalition for Ethanol CEO Brian Jennings, referring to higher ethanol blends the industry seeks to make more widely available nationwide.

How Plan to Boost Ethanol Will Reverberate Across US: QuickTake

The industry is hopeful demand picks up soon. Pat Bowe, CEO of Andersons Inc., an ethanol producer and grains handler, said he sees driving demand holding roughly 1% to 2% above last year’s levels. Meanwhile, Renewable Fuels Association’s Cooper expects gasoline usage during the busiest summer periods to surpass levels not seen since August 2019. Still, for now, the proposed quotas make sense based on lackluster gasoline consumption, said Ken Morrison, a St. Louis-based independent commodity trader.

While the trimmed quotas won’t have a near-term impact on blending, they still sent tumbling the value of tradable credits known as RINs, which are used to prove quotas have been fulfilled. On Wednesday, RINs tracking ethanol and biomass-based diesel fell as much as 10% in the day’s trading to the lowest levels in more than a year. With the changes more likely to impact the longer-term outlook, the spot ethanol market shrugged off policy woes and gained 4.5% to the highest level since November.

--With assistance from Chunzi Xu, Sophie Caronello and Barbara Powell.

Author: Kim Chipman and Jennifer A. Dlouhy