Billionaire Bernard Arnault has bought €215 million ($230 million) of LVMH shares since the luxury conglomerate’s disappointing earnings in late July contributed to a drop in the stock price.

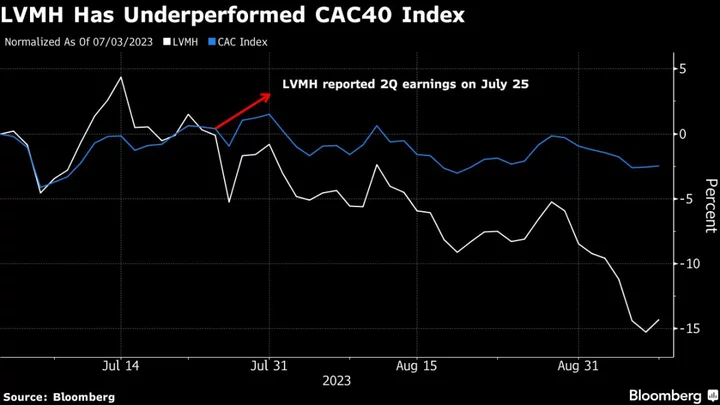

Arnault’s Financiere Agache and Christian Dior SE vehicles began buying LVMH Moet Hennessy Louis Vuitton SE three days after the July 25 earnings report, French regulatory filings show. The stock has slumped 14% since then, weighed down by slowing economies in China and the US, persistent inflation and rising interest rates.

The French businessman and his family own about 48% of LVMH’s shares with almost 64% of the voting rights. Arnault, the world’s second-wealthiest individual, regularly buys LVMH stock, with breaks for the blackout periods around earnings reports, the filings show.

A representative for Arnault declined to comment.

LVMH’s second-quarter results showed the luxury behemoth, owner of brands such as Louis Vuitton and Tiffany & Co., has been struggling in the US, with organic revenue falling 1% there. That performance spooked investors, with shares dropping 5.2% the next trading session, a move that dragged the whole sector down as well as the CAC 40 Index.

The 7.8% drop in LVMH shares last month was the biggest monthly decline since December. The slump last week dethroned LVMH as the biggest European company by market value, with Danish drugmaker Novo Nordisk A/S overtaking the luxury giant thanks to booming sales of its Ozempic obesity treatment.

That means Arnault’s wealth has come down from a record $212.4 billion in mid-July. As of Thursday, it stood at $170.4 billion, behind Elon Musk’s $230.7 billion, according to the Bloomberg Billionaires Index.

LVMH shares are still up by about 8.8% for the year.