Mexico’s central bank will hold interest rates at a record-high for at least the next two meetings before beginning to consider easing, bank Governor Victoria Rodriguez said Wednesday.

Banxico, as the central bank is known, will exercise caution at upcoming meetings as policymakers have no set timeline for easing policy from the current 11.25%, Rodriguez said during a presentation of the bank’s quarterly report.

Policymakers will “take a longer time than we can have between two monetary policy decisions” to thoroughly evaluate the inflationary outlook and balance of risks, she said, adding that a potential recession in the US will also play a role of when the central bank starts cutting rates.

The central bank ended its record monetary tightening cycle on May 18 after increasing its key rate 725 basis points over 15 straight hikes starting in June 2021. Borrowing costs are now at their highest level since the bank started targeting inflation in 2008.

On Wednesday, the central bank cut its projections for consumer price increases to 4.7% by the end of 2023, from 4.9% in its March 1 publication.

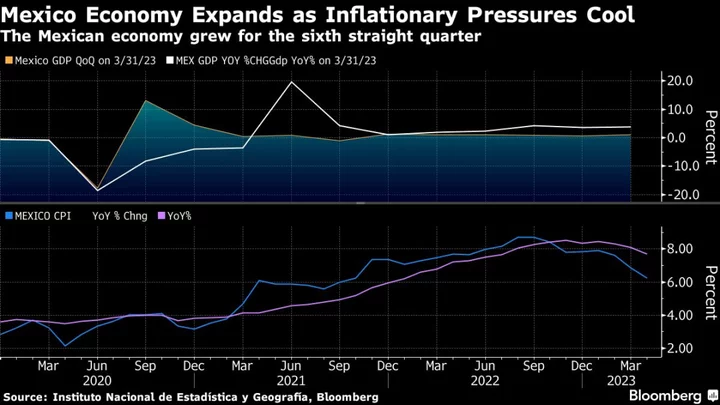

The most recent inflation data showed a bigger-than-expected deceleration in early May, with the annual pace slowing to 6%, down from a peak of 8.8% in August but still more than double the central bank’s 3% target.

Rodriguez’s comments were echoed by other board members during the call, including Banxico Deputy Governor Irene Espinosa, who said the bank will keep its restrictive stance on rates.

“Would there be room to start seeing cuts in rates? This scenario is possible, but in my opinion, it is unlikely. We are facing very high levels of inflation, especially core inflation, and with a phenomenon of persistence,” said Espinosa, discarding the possibility that the bank will start its easing cycle in September.

Mexico’s peso weakened Wednesday alongside most emerging-market currency peers.

GDP Projections

Mexico’s central bank raised its 2023 economic growth forecast for Latin America’s second-biggest economy as exports and remittances run at record highs.

Banxico, as the central bank is known, estimates that gross domestic product will expand 2.3% this year, according to the main scenario of its quarterly inflation report released Wednesday. In a previous report published March 1, it forecast growth of 1.6%.

For 2024, it revised down its GDP growth expectation to 1.6% from 1.8%.

Mexico saw sustained domestic consumption and strong foreign demand, especially from the US, during the first quarter. The economy is expected to continue benefiting from strong remittance flows and record exports to the US before a slowdown in activity.

Policymakers in their post-decision communique remained cautions and signaled that interest rates will need to be held at restrictive levels for a prolonged period.

Economists in a Citibanamex survey published last week kept their 2023 growth forecast at 1.9%, up from 1% in early February. They also forecast that the central bank’s key rate would end the year at its current level.

--With assistance from Rafael Gayol, Dale Quinn, Carolina Gonzalez and Alex Vasquez.

(Updates with governor comments on policy horizon in headline, first and fourth paragraphs)