The Federal Reserve’s stress test is usually the most dreaded part of Wall Street firms’ annual capital planning. This year, it’s just the first hurdle to clear as regulators explore more stringent requirements on banks in the aftermath of several lender collapses.

The test results, set to be released Wednesday afternoon, mark the beginning of a trio of regulatory actions that will impact how much capital banks are required to hold on their balance sheets. The two that follow are likely to be far more burdensome.

Analysts largely expect banks to sail through the tests, which examine how lenders would hold up in a hypothetical severe global recession in which US unemployment peaks at 10%, commercial real estate prices plunge 40% and the dollar surges against most major currencies. In past years, the test results would be accompanied by a flurry of press releases from the largest US lenders announcing their plans to return any excess capital to shareholders.

This year, however, many banks have warned they’ll be waiting for additional clarity from regulators before committing to big payouts. That’s because, on the heels of this week’s test results, regulators are poised to unveil the long-awaited Basel III Endgame requirements that will revamp capital rules for banks. The Fed has also warned it plans to make changes to bank supervision following the collapse of four regional banks earlier this year.

“We’re currently in a lot of bank uncertainty, and the stress tests, we expect, will show that the US banking industry is really strong,” Barclays Plc analyst Jason Goldberg said in an interview. Still, “in prior years, where it served as a catalyst for large dividend increases and share buybacks, given all the other uncertainties out there with respect to the economy and capital reform, it is probably less meaningful this year than others.”

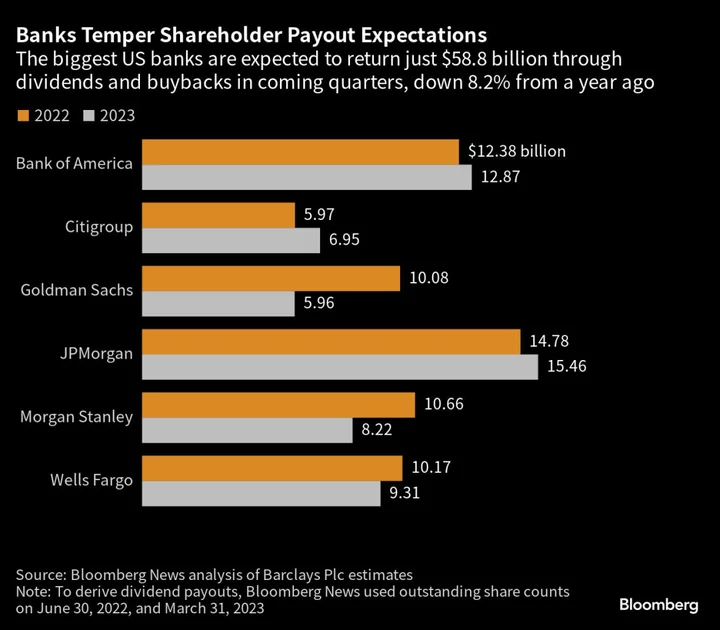

Indeed, in recent weeks, bank executives have been trying to temper shareholders’ expectations.

“We will make the decision on a quarter-by-quarter basis as we go,” Wells Fargo & Co. Chief Financial Officer Michael Santomassimo told investors of payouts at a conference this month. “We’ve got Basel III finalization coming at some point. You’ve still got a bit of an uncertain economic environment. So you do need to keep all of that in your thinking around what you’re going to do for your capital.”

At the same conference, U.S. Bancorp Chief Executive Officer Andy Cecere, asked if he plans to restart buybacks anytime soon, said that his firm would have to be “very prudent about capital management” ahead of the unveiling of the Basel III framework. Also at the conference, Huntington Bancshares Inc. Chief Financial Officer Zachary Wasserman said his firm will “go into 2024 and set a new capital plan at that point” after it has a better picture of changing regulations and more clarity on the macroeconomic environment.

Elsewhere, JPMorgan Chase & Co. President Daniel Pinto said the most likely scenario to come out of the next few months of shifting regulations is his bank has to hold “some more capital.”

Last year, the Fed told banks it expected them to wait two trading days after the release of stress-test results before publicly disclosing any information about their planned capital actions and new capital requirements. This year, that means investors don’t expect any formal announcements from lenders until Friday afternoon at the earliest.

Many analysts are expecting some lenders to face an increase in their so-called stress-capital buffers. A year ago, that spelled pain for banks including Citigroup Inc. and JPMorgan, forcing them to limit increases to their dividends and buybacks.

“This year, we expect to see similar results, where many banks will have their stress-capital buffers increased,” RBC Capital Markets analyst Gerard Cassidy said in an interview. “We do not expect many banks to announce buybacks following the stress tests. There will be some dividend increases, but they probably will be modest for the most part.”

Bank Failures

The biggest US banks have spent years waiting for the so-called endgame of Basel III, a long-awaited reform that’s part of an international overhaul of capital rules in the wake of the 2008 global financial crisis.

And in the aftermath of this year’s failure of regional banks including Silicon Valley Bank, regulators have said they’re planning more stringent rules for the industry. Martin Gruenberg, chairman of the Federal Deposit Insurance Corp., said this month that regulators are weighing a plan that would require US banks with at least $100 billion in assets, and not just the country’s largest lenders, to adhere to Basel III requirements.

The eight biggest US banks will bear the brunt of regulators’ moves to raise capital requirements, Fed Chairman Jerome Powell told lawmakers last week. The largest lenders could face an increase of about 20% in what they have to set aside, Powell told members of the Senate Banking Committee, though details are still in flux and specifics could change.

“The Fed stress test is the first of three regulatory waves of summer that also include Basel III and new Fed oversight post-SVB,” Wells Fargo analyst Mike Mayo wrote in a note to clients. “Many regional banks are excluded from the test, and the potential regulatory impact is likely smallest of the three waves.”