By Michael S. Derby

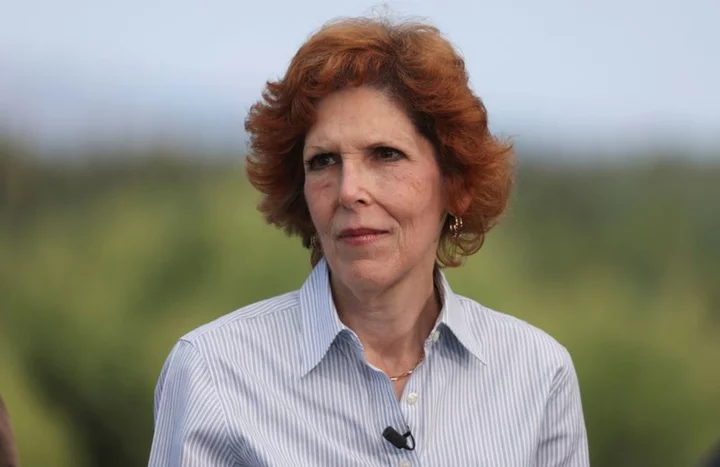

NEW YORK Cleveland Federal Reserve President Loretta Mester said on Wednesday that the U.S. central bank's new real-time money moving system is being designed in a way that should help ensure financial stability should bank stress arise.

Mester acknowledged concerns that FedNow, a real-time, all-hours payment system the central bank is making available to banks, could exacerbate banking troubles by facilitating fast outflows from financial institutions, in effect super-charging a potential bank run.

She said it will be up to the users of FedNow themselves to use transfer limits. "Banks have tools they could use to mitigate large outflows of deposits," including limiting how much money can be moved over a given period, restricting who can use the system, and firms can determine which direction money can flow in real time, Mester said in a speech to the National Bureau of Economic Research Summer Institute.

"Future releases of the FedNow Service may allow configurable transaction limits by customer type, if such limits are deemed useful," she added.

Mester said banks can also plan for how they can tap Fed emergency lending and private sources of liquidity, should they need it.

"In addition to a bank being able to borrow from the Fed during the hours the discount window is open, a bank could use liquidity management transfers to replenish its master account balance from private funding sources on the weekend when the discount window is not accessible, which would help to mitigate the effects of deposit outflows on the health of the bank," Mester said.

Mester's comments on mitigating the financial stability risks of the real-time payment system were rooted in events in the spring, when trouble at a limited number of banks spooked the global financial system, and were in part rooted in anxious customers moving funds from affected banks very quickly.

Mester did not comment on monetary policy in her prepared remarks.

(Reporting by Michael S. Derby; Editing by Paul Simao)