Baidu Inc.’s revenue rose its most in more than a year, joining China’s largest internet companies in rediscovering growth after Beijing relaxed its grip on the private sector to try and jumpstart a faltering economy.

Its shares rose about 4% in pre-market trading in New York. The company reported a 15% jump in sales to 34.1 billion yuan ($4.7 billion) for the June quarter, versus estimates for 33.3 billion yuan. Net income rose 43% to 5.2 billion yuan.

Like Alibaba Group Holding Ltd. and Tencent Holdings Ltd., China’s search leader is riding a recovery in advertising and consumer spending from the depths of the Covid Zero era in 2022. That’s despite increasing turbulence in the world’s No. 2 economy that emerged in past months, from stubbornly high unemployment to a property crisis. On Tuesday, video platform Kuaishou Technology reported its first net income on record after sales beat expectations.

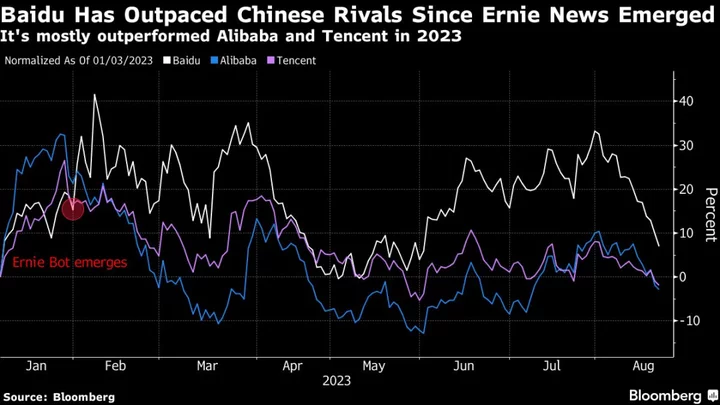

Investors for now are focused on Baidu’s AI ambitions, since the Chinese company demonstrated its domestic leadership by unveiling a ChatGPT-rival called Ernie in March. Alibaba and Tencent have since joined a parade of startups in touting their own large language models to try and match OpenAI’s seminal creation in recent months, raising questions about whether Baidu can sustain its current lead.

Baidu reiterated that it has upgraded the AI model underpinning Ernie Bot, its answer to ChatGPT, without mentioning a date for a public rollout.

Baidu’s Results May Shake Optimism Over China AI: Tech Watch

In June, the company — also China’s leader in autonomous driving — claimed Ernie has outperformed ChatGPT on several measures. But Tencent said last week its own model in development was already one of China’s best, while Alibaba is integrating a ChatGPT-like AI into its meeting and messaging apps.

Baidu hopes its creation — built atop its years of investment, research and development in AI technology — will become the next must-have app for the world’s largest internet arena, luring users back from all-in-one platforms like Tencent’s WeChat. Baidu is integrating Ernie Bot across business lines ranging from cloud computing to smart speakers. It also set aside a $140 million venture fund to invest in OpenAI-like startups.

Beijing-based Baidu has in past years sought to move beyond its roots as a search and marketing firm toward a provider of technology like AI and autonomous driving. The cloud computing arm became a growth engine during China’s downturn, while its driverless taxis expanded into more cities like Wuhan and Chongqing.

The company’s shares have gained about 10% this year through Friday, ranking among the best performers on the Hang Seng Tech Index, which has lost 3%.

Lackluster consumption and rising competition remain key hurdles. Investors betting on an extension of Baidu’s market-beating rally may be due for a reality check as concerns about the sluggish Chinese economy and setbacks from a key segment of its business deepen.

And without a stronger demand pull or updates to its AI project, the outlook for its shares is cloudy at best.

“Baidu is viewed as being in the lead for generative AI because of its more visible investments over the years,” said Vey-Sern Ling, managing director at Union Bancaire Privee. “But the development of generative AI applications is still at an early stage.”

(Updates with share action from the second paragraph)