Australia’s consumer confidence slumped in November following the Reserve Bank’s resumption of interest-rate increases, as households hunkered down amid concerns of further tightening to come.

Sentiment declined 2.6% to 79.9 points, with pessimists still heavily outweighing optimists given a reading of 100 is the dividing line, a Westpac Banking Corp. survey showed Tuesday. The index has held in a 78-86 range for the past year.

“The RBA’s November rate hike has put renewed pressure on family finances and reignited concerns about both the rising cost of living and the prospect of further rate rises to come,” said Matthew Hassan, a senior economist at Westpac. “Pessimism is having a major bearing on spending attitudes.”

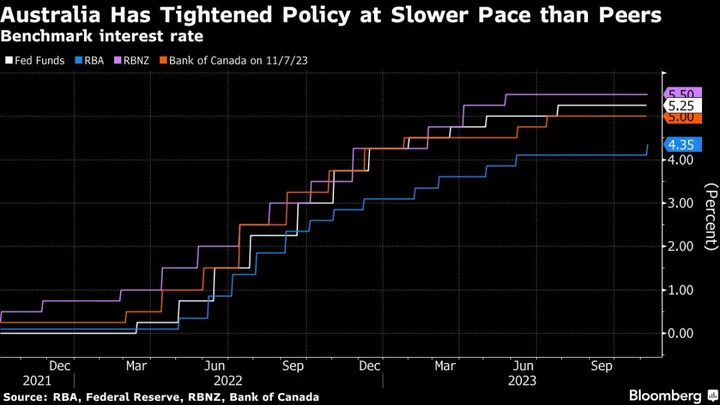

The poll was conducted from Nov. 6-10, spanning the RBA’s Nov. 7 meeting when it lifted the cash rate to a 12-year high of 4.35%, ending four pauses. The hike “knocked 6% off confidence during the survey week,” Westpac said.

The RBA has warned that further tightening may be required as inflation proves stubborn, with the bank having already lifted borrowing costs by 4.25 percentage points since May last year. Like much of the developed world, Australia’s services prices are showing signs of stickiness amid a tight labor market and strengthening wage growth.

Tuesday’s report showed assessments of “family finances compared to a year ago” rose 2%, but remain at “extremely weak” levels. The “family finances next 12 months” sub-index slumped 7.3% to 87.

A gauge of the outlook for household spending, “the time to buy a major household item” sub-index slid 1.4% to 81.3, falling into “the bottom 2% of observations since the survey began,” Westpac said.

The report showed the “time to buy a dwelling” index declined 3.7%.

The RBA next meets on Dec. 5 with economists generally expecting no change to rates.

“The November Consumer Sentiment survey highlights the weak and uneven conditions across Australia’s consumer sector,” Hassan said. “How this plays out for wider domestic demand in the context of strong population growth is something the board will need to consider as it acts to ensure inflation returns to target.”