The Australian dollar and US equity futures rose in early Asian trading Monday amid signs of improving ties between the US and China, while contracts for benchmarks in Asia showed muted moves.

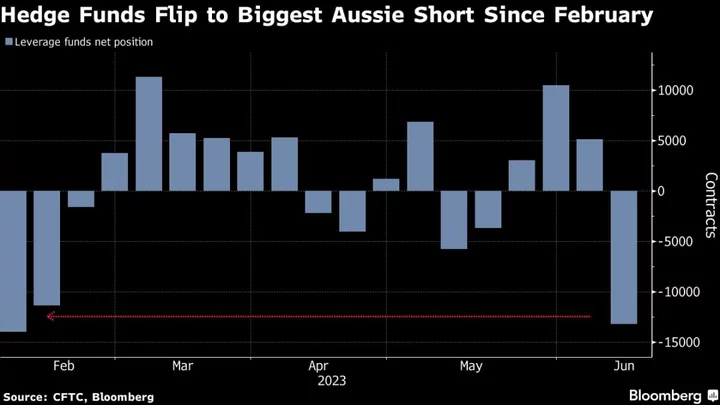

The Australian dollar edged higher against the greenback, adding to its 2% rise last week — the currency’s third consecutive weekly gain against the dollar. The advance has attracted hedge funds to short the currency.

The small advance Monday follows positive signs Sino-US relations will thaw, and also ongoing optimism China will unleash fresh stimulus to boost its flagging recovery.

US Secretary of State Anthony Blinken had “candid” talks with his counterpart in Beijing in a meeting that ran longer than planned. President Joe Biden said Saturday he hoped to meet Chinese president Xi Jinping in the next several months.

Futures contracts for Australian and Hong Kong equities were slightly lower, mirroring the decline in US stocks Friday, while Japanese contracts made a small advance.

Investors are keenly monitoring for signs of further official support for the Chinese economy after the country cut a key lending rate last week. The country is set to cut one and five year loan prime rates in decisions expected Tuesday, according to economist forecasts.

Nomura Holdings Inc., Standard Chartered Plc and Morgan Stanley have said authorities may increase the quota for local government special-purpose bonds to finance infrastructure investments in a potential stimulus package to boost growth.

US stock and bond markets will be closed for the Juneteenth holiday Monday. The S&P 500 declined 0.4% Friday to end a six-session streak of advances as investors look for more insight on Federal Reserve interest rate decisions.

Fed Chair Jerome Powell will give his semi-annual report to Congress on Wednesday. Federal Reserve Bank of St. Louis President James Bullard and his counterparts in New York and Chicago are all set to speak in the week ahead.

The Fed kept interest rates unchanged last week but warned of more tightening ahead. In the past, pausing rate hikes for three months after such a run of interest rate hikes has boosted stock prices.

Other key central bank developments in the week ahead include policy meetings in Turkey, the UK and Switzerland.

Key events this week:

- US Juneteenth holiday, Monday

- China loan prime rates, Tuesday

- US housing starts, Tuesday

- Federal Reserve Bank of St. Louis President James Bullard speaks, Tuesday

- New York Fed President John Williams speaks, Tuesday

- Federal Reserve Chair Jerome Powell delivers semi-annual congressional testimony before the House Financial Services Committee, Wednesday

- Federal Reserve Bank of Chicago President Austan Goolsbee speaks, Wednesday

- Eurozone consumer confidence, Thursday

- Rate decisions in UK, Switzerland, Indonesia, Norway, Mexico, Philippines, Turkey, Thursday

- US Conference Board leading index, initial jobless claims, current account, existing home sales, Thursday

- Federal Reserve Chair Jerome Powell delivers semi-annual testimony to Congress before the Senate Banking Committee, Thursday

- Cleveland Fed’s Loretta Mester speaks, Thursday

- Eurozone S&P Global Eurozone Manufacturing PMI, S&P Global Eurozone Services PMI, Friday

- Japan CPI, Friday

- UK S&P Global / CIPS UK Manufacturing PMI, Friday

- US S&P Global Manufacturing PMI, Friday

- Federal Reserve Bank of St. Louis President James Bullard speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.2% as of 7:24 a.m. Tokyo time. The S&P 500 fell 0.4% Friday

- Nasdaq 100 futures rose 0.3%. The Nasdaq 100 fell 0.7%

- Nikkei 225 futures rose 0.1%

- Hang Seng futures fell 0.7%

- S&P/ASX 200 futures were little changed

Currencies

- The Bloomberg Dollar Spot Index rose 0.1%

- The euro was little changed at $1.0938

- The Japanese yen was little changed at 141.92 per dollar

- The offshore yuan was little changed at 7.1307 per dollar

- The Australian dollar was little changed at $0.6876

Cryptocurrencies

- Bitcoin fell 0.2% to $26,418.83

- Ether fell 0.2% to $1,726.44

Commodities

- West Texas Intermediate crude fell 0.5% to $71.40 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.