Factories in Asia continued to experience weaker activity in July amid China’s economic woes, signaling that a manufacturing turnaround could still be far off.

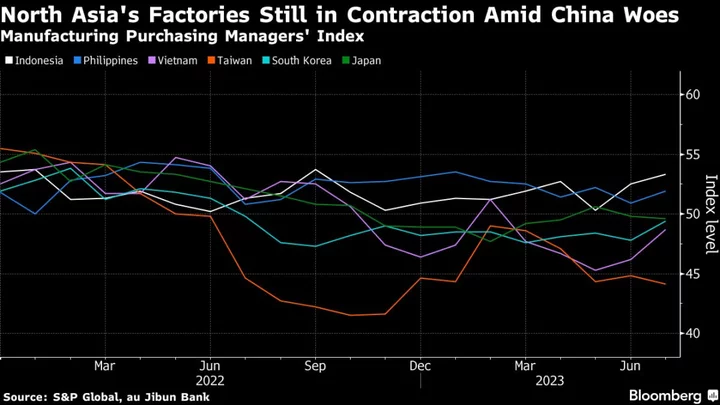

Factory activity in North Asia contracted last month as lukewarm demand for goods hit new orders, output and export sales. The slump was led by Taiwan, with the manufacturing Purchasing Managers’ Index sliding to an eight-month low of 44.1, while Japan’s dipped slightly to 49.6, according to S&P Global and au Jibun Bank.

“Declines in output, new orders and export sales all gathered pace, with firms blaming weaker global economic conditions and high inventory levels at clients,” Annabel Fiddes, economist at S&P Global Market Intelligence, said of Taiwan’s reading. “The data therefore suggest a weak performance entering the third quarter, with little sign that things will pick up in the near-term.”

Bucking the trend is export powerhouse South Korea, which saw its reading improve to 49.4 in July from 47.8 in the previous month, but still below the 50 mark that separates expansion from contraction. It was its softest decline in a year, nudging manufacturers to increase staffing and purchasing.

Domestic demand partly helped insulate Southeast Asia, with new business and steady production propelling factory activity to expand to a region’s best 53.3 in Indonesia and 51.9 in the Philippines. The downturn in manufacturing hub Vietnam, meanwhile, eased to 48.7 from 46.2 amid subdued demand in its export markets.

The PMI readings cloud the outlook for Asia, which was banking on a manufacturing revival to help drive economic growth after the easing of pandemic restrictions and supply chain bottlenecks. A disappointing rebound in China, combined with sticky inflation in the US and Europe, are sapping demand for the region’s goods.

China’s official manufacturing purchasing managers’ index rose slightly to 49.3 in July, beating economists’ estimates but still remaining in contraction territory for the fourth straight month. That’s prompted Beijing to unveil more stimulus measures to spur consumption, including for industries involved in home goods, food, plastic products, leather and other sectors.

(Updates with more details throughout.)