Asian stocks are set to slide following US peers lower, driven by the continued sell-off in Treasuries and increasing tensions in the Middle East.

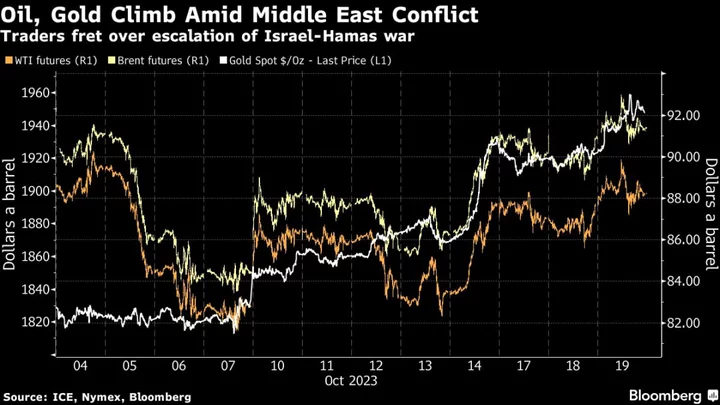

Australian shares fell at the open while futures contracts in Japan and Hong Kong pointed to early losses. Oil steadied after extending its rally in the previous session with the US suspending some sanctions on Venezuelan output. Gold also extended gains amid demand for safe-haven assets. The precious metal has now risen over 4% in the last five days.

Australian and New Zealand bond yields surged in early trading, after rates on Treasuries climbed Wednesday, pushing the dollar higher. Fed Bank of New York President John Williams said interest rates will have to stay at restrictive levels “for some time” to bring inflation back to the central bank’s target.

Meanwhile, traders are preparing for turbulent yen trading amid growing concerns that Japanese authorities will intervene to support the weakening currency as it approaches the 150 per dollar level.

Oil’s rally came as Iran intensified its rhetoric against Israel after an explosion at a Gaza hospital that complicated diplomatic efforts to rein in the Middle East conflict. United Airlines Holdings Inc. tumbled almost 10% after warning the Israel-Hamas war and higher jet fuel costs would weigh on earnings. UK Prime Minister Rishi Sunak is set to visit Israel on Thursday.

“The risks of an escalation have risen on the back of the latest news reports regarding the hospital bombing,” said Jane Foley, head of foreign-exchange strategy at Rabobank. While there have been few signs of panic, “on any clear escalation, we can expect to see a ratcheting up of risk aversion,” she said.

Contracts for US equities were little changed in early Asia trading after the S&P 500 slumped 1.3% on Wednesday. Netflix rallied post-market after strong earnings while the Golden Dragon index - a gauge of Chinese companies listed in the US - slid 2.2%.

Treasury yields remain at multi-decade highs with Fed Governor Christopher Waller noting policymakers can wait and gather more data before deciding if the economy needs further monetary restraint.

“A reiteration of the ‘higher for longer’ message on interest rates may allow US yields to stay at or above their current levels and keep the dollar supported,” said Carol Kong, a strategist at Commonwealth Bank of Australia.

Still, elevated yields are attracting buyers, with a 20-year auction seeing its yield lower than indicated pre-auction trading, helping cap a rise in long-dated yields. Fed Chair Jerome Powell is set to speak at the Economic Club of New York on Thursday.

Key events this week:

- Australia unemployment, Thursday

- Japan trade, Thursday

- China property prices, Thursday

- US initial jobless claims, existing home sales, leading index, Thursday

- Federal Reserve Chair Jerome Powell, Chicago Fed President Austan Goolsbee, Atlanta Fed President Raphael Bostic, Philadelphia Fed President Patrick Harker, Dallas Fed President Lorie Logan speak at different events, Thursday

- Japan CPI, Friday

- China loan prime rates, Friday

- Philadelphia Fed President Patrick Harker speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 8:19 a.m. Tokyo time. The S&P 500 fell 1.3%

- Nasdaq 100 futures were little changed. The Nasdaq 100 fell 1.4%

- Hang Seng futures fell 1.1%

- Australia’s S&P/ASX 200 fell 1.3%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0539

- The Japanese yen was little changed at 149.86 per dollar

- The offshore yuan was little changed at 7.3270 per dollar

- The Australian dollar was little changed at $0.6332

Cryptocurrencies

- Bitcoin rose 0.3% to $28,337.49

- Ether was little changed at $1,563.74

Bonds

- The yield on 10-year Treasuries advanced eight basis points to 4.91%

- Japan’s 10-year yield advanced 2.5 basis points to 0.805%

- Australia’s 10-year yield advanced 10 basis points to 4.74%

Commodities

- West Texas Intermediate crude was little changed

- Spot gold rose 0.2% to $1,950.70 an ounce

This story was produced with the assistance of Bloomberg Automation.