Stock futures for Asia suggested a subdued open to trading around the region Thursday as investors weigh central bank hawkishness and position for the end of the quarter.

Contracts for Japanese shares rose slightly while those for Australia and Hong Kong edged down. An index of US-listed Chinese equities declined.

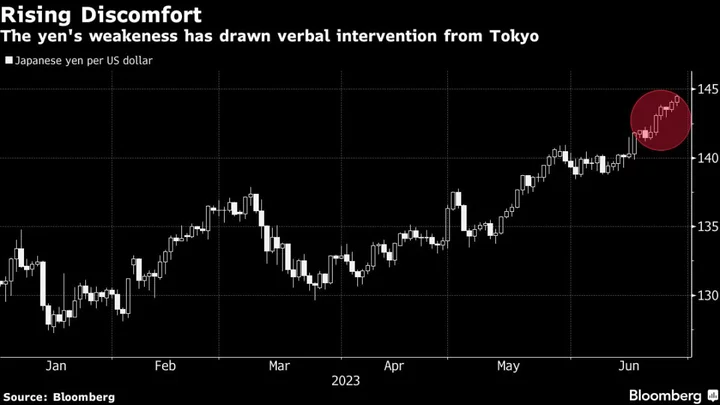

The Australian and New Zealand dollars steadied after falling more than 1% on Wednesday. The yen was little changed after moving away from its weakest point in seven months after the Bank of Japan governor indicated it might be possible to start normalizing monetary policy if he becomes confident in a pick-up in inflation for next year.

Governor Kazuo Ueda was speaking at central banking forum in Portugal, where Federal Reserve Chair Jerome Powell signaled the Fed may raise rates at the next two meetings after June’s pause. Their counterpart at the European Central Bank, Christine Lagarde, said the ECB would hike next month if current trends hold.

On Wall Street, traders took Powell’s comments in stride, with bond yields down and stocks fluctuating.

The tug of war within the S&P 500’s most-influential group dictated trading Wednesday, with a slide in chipmakers offsetting an advance in tech megacaps like Apple Inc. and Microsoft Corp.

After the closing bell, Bank of America Corp. and Wells Fargo & Co. led gains in financial companies as the biggest lenders passed the Federal Reserve’s annual stress test, clearing the way for payouts. Micron Technology Inc. jumped on an upbeat forecast.

“Quarter-end positioning could drive volatility through the end of the week,” said Mark Hackett, chief of investment research at Nationwide. “Investors are increasingly pricing in a soft landing. A reacceleration in earnings will be required to drive the next phase of the market move.”

Swap market bets on further tightening barely budged after the Fed’s chief downplayed the odds of a recession while signaling officials could hike for two straight meetings, if needed.

Meantime, BlackRock Inc. introduced a bullish call on AI amid a rally that’s putting the Nasdaq 100 on pace for its best-ever first half of a year.

Elsewhere, oil declined Thursday after a gain in the previous session following a US government report showing nationwide stockpiles fell the most in two months.

Key events this week:

- Eurozone economic confidence, consumer confidence, Thursday

- US GDP, initial jobless claims, Thursday

- Atlanta Fed President Rafael Bostic speaks, Thursday

- China manufacturing PMI, non-manufacturing PMI, balance of payments, Friday

- US personal income and spending, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.2% as of 7:17 a.m. Tokyo time. The S&P 500 was little changed

- Nasdaq 100 futures 0.2. The Nasdaq 100 rose 0.1%

- Nikkei 225 futures rose 0.3%

- Australia’s S&P/ASX 200 Index futures fell 0.1%

- Hang Seng Index futures fell 0.2%

Currencies

- The euro was little changed at $1.0914

- The Japanese yen was little changed at 144.36 per dollar

- The offshore yuan was little changed at 7.2454 per dollar

- The Australian dollar was little changed at $0.6599

Cryptocurrencies

- Bitcoin rose 0.2% to $30,177.95

- Ether was little changed at $1,832.72

Bonds

- The yield on 10-year Treasuries declined six basis points to 3.71%

Commodities

- West Texas Intermediate crude fell 0.5% to $69.21 a barrel

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth and Toby Alder.