Emerging Asia ex-China bonds have beaten their developing-nation peers this quarter, and this outperformance looks set to continue even if US interest rates keep rising.

Regional securities have fared better even though their emerging-market counterparts have had the benefit of monetary easing as central banks start cutting rates. There are multiple factors working in favor of Asian notes including a lower correlation to US yields, support from resilient currencies and disinflationary pressures exported by China.

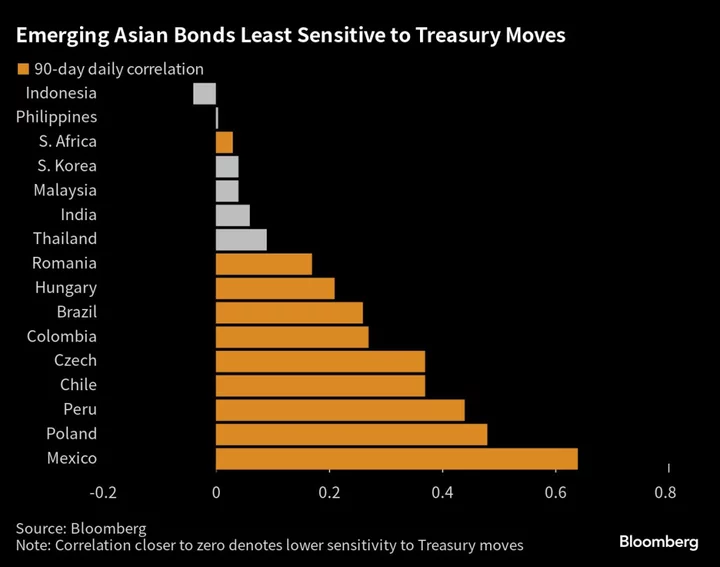

The average 90-day correlation between yields in emerging Asia ex China versus Treasuries stands at close to zero. In comparison, the same measure for yields in Europe, the Middle East and Africa is at 0.32, and 0.36 for Latin America, according to Bloomberg’s calculations.

While the rapidity of the rise in US yields is challenging bond investors globally, “in Asia, there is a cold counter-cyclical wind coming from China, which has a much more significant impact on emerging Asian economies that supports the local bond markets,” said Rajeev De Mello, a Geneva-based global macro portfolio manager at Gama Asset Management SA.

This trend may prompt investors to rethink their bullish bets on emerging market bonds that were based on expectations these curves would shift lower as rate cuts pick up pace. Central banks in Chile, Brazil and Hungary have lowered key rates this quarter while Peru, Colombia, Mexico, the Czech and Poland are all expected to join the easing bandwagon later this year, according economists surveyed by Bloomberg.

In contrast, central banks in Indonesia, Philippines, Thailand, Malaysia, India and South Korea are forecast to keep rates unchanged this year, according to economists surveyed by Bloomberg. Still, an average of 10-year benchmark yields from emerging Asia ex-China has risen 17 basis points this quarter, less than the 20 basis points gain recorded in EMEA and 40 basis points increase in Latin America, according to Bloomberg calculations.

Latin American and Central and Eastern European currencies have also underperformed, falling by at least 2.4% versus the greenback this quarter, while Asian currencies have declined by around 2.3%. The relative strength of Asia’s currencies helps boost the appeal of the region’s assets.

Asian yields are anchored by various factors including a stable or sanguine bond supply outlook, as well as a dovish policy rate view, said Frances Cheung, a rates strategist at Oversea-Chinese Banking Corp. in Singapore. “Despite compressed yield differentials with Treasuries, these differentials may stay narrow,” she added.

(Updates prices in 6th and 7th paragraphs.)