Asia stock futures rose after a renewed rally in tech giants pushed Wall Street higher, with focus turning to Friday’s jobs report amid bets the Federal Reserve will pause its interest-rate hikes in June.

Contracts for equity benchmarks in Japan, Hong Kong and Australia advanced. The frenzy for artificial intelligence stocks saw Nvidia Corp. climb 5%, leading gains in the Nasdaq 100. Traders also geared up for the monthly jobs report on Friday, with forecasters projecting a moderation in the pace of hiring that could potentially allow the Fed to pause its tightening policy in June. Bond yields declined and the dollar fell the most in more than two months.

The obsession for anything AI-related drove megacaps up 17% in May. However, Broadcom Inc., one of the world’s biggest chipmakers, said after the closing bell that demand for gear that powers AI is helping fuel sales, but not enough to offset a broader post-pandemic slowdown.

“One can rightly ask how many more ‘Mays’ we can have, where US big tech is almost the only place to find outsized positive equity returns anywhere in the world,” said Nicholas Colas, co-founder of DataTrek Research. “The old Keynesian saying that goes, ‘markets can remain irrational longer than you can stay solvent’ feels especially relevant in the current investment environment.”

The S&P 500 rose 1% on Thursday, reclaiming its 4,200 mark. A contrarian indicator from Bank of America Corp. that tracks Wall Street strategists’ average recommended allocation to stocks is the closest it has been to notching a “buy” signal in over six years.

To Matt Maley at Miller Tabak, no matter how bullish investors might be about the potential for AI, they should be prepared to weather corrections along the way.

“Investors will need to be quite careful, and extremely nimble, after these recent parabolic advances,” Maley said. “Sometimes, the deep corrections are long-lasting, like we saw after the dot-com bubble burst. Sometimes, they only last for a few weeks and are followed by new, very strong rallies that take the stocks even higher.”

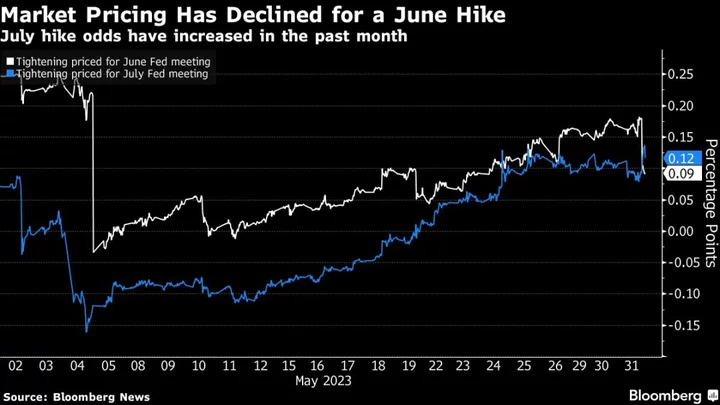

Federal Reserve officials are signaling they plan to keep interest rates steady in June while retaining the option to hike further in coming months, steering market expectations ahead of a key employment report.

Fed Bank of Philadelphia President Patrick Harker said “we should at least skip this meeting in terms of an increase. In an essay Thursday, his St. Louis counterpart James Bullard, said he believes interest rates are at the low end of what’s likely to be sufficiently restrictive to bring down inflation.

Meantime, the Treasury is considering postponing its regular three- and six-month bill auctions “tentatively” scheduled for next Monday if constraints around the statutory debt limit remain.

Senators scrambled Thursday to agree on a plan for swift consideration of the debt-limit deal forged by President Joe Biden and House Speaker Kevin McCarthy ahead of a June 5 deadline to avert a destabilizing default.

In other markets, the Bloomberg Commodity Index on Thursday followed the rally on Wall Street but is still set for a seventh weekly drop, its longest such streak since 2015, on China’s sluggish economy. Oil traders will be looking to an OPEC+ meeting over the weekend to discuss the group’s production policy.

Some of the main moves in markets:

Stocks

- Hang Seng futures rose 1.8% as of 7:03 a.m. Tokyo time

- Nikkei 225 futures rose 0.8%

- S&P/ASX 200 futures rose 0.7%

- The S&P 500 rose 1%; S&P futures rose 0.1%

- The Nasdaq 100 rose 1.3%; Nasdaq 100 futures increased 0.1%

Currencies

- The Bloomberg Dollar Spot Index fell 0.6%

- The euro was unchanged at $1.0762

- The Japanese yen was little changed at 138.82 per dollar

- The offshore yuan was unchanged at 7.1044 per dollar

- The Australian dollar was little changed at $0.6572

Cryptocurrencies

- Bitcoin rose 0.2% to $26,914.12

- Ether was little changed at $1,869.86

Bonds

- The yield on 10-year Treasuries declined five basis points to 3.6%

Commodities

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.