Asian equities look set for mixed start Wednesday while US contracts posted muted gains after leaders in Washington expressed cautious optimism about a bipartisan deal after debt-ceiling talks.

Stock futures for Australia and Hong Kong fell while Japanese contracts ticked higher, indicating further gains for the country’s share benchmarks after the Topix Index closed at the highest level in 33 years on Tuesday. Wall Street strategists pointed to the country’s corporate reforms and loose monetary policy as reasons for further optimism.

US stock futures edged higher in early trading after the Nasdaq 100 managed a small advance and the broader S&P fell, following a rapid decline in the final minutes of the session.

President Joe Biden and House Speaker Kevin McCarthy were hopeful when asked whether a deal could be struck within days to end a stalemate ahead of a potential US default.

“Since both sides know what is at stake, default is improbable,” said Seema Shah, chief global strategist at Principal Asset Management. “However, every day closer to the Treasury’s June 1 deadline without a resolution will likely elevate volatility in markets, trim demand for US risk assets, and even expedite recession.”

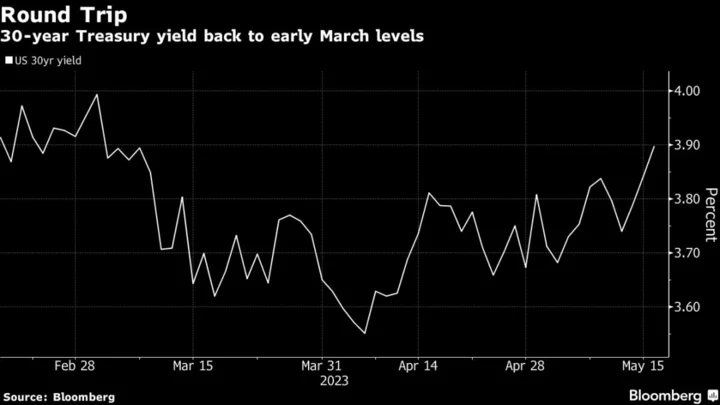

New Zealand bond yields were slightly higher ahead of New Zealand’s budget, which is anticipated to show rising debt and wider deficits. Australian bonds also fell, following selling in Treasuries Tuesday that pushed yields higher across the US curve. The rate on 30-year notes climbed to around 3.9% — the highest since the run-up to the banking turmoil that erupted in early March. Bond markets also digested news of Pfizer Inc.’s $31 billion debt sale, one of the largest on record.

Richmond Federal Reserve President Thomas Barkin said he was still looking to be convinced that inflation has been defeated and that he’d support raising rates further if needed. Cleveland Fed President Loretta Mester said the central bank is unable to do much about slow long-term economic growth, but can “do its part” by curbing prices.

US retail sales increased in April, suggesting consumer spending is holding up in the face of economic headwinds including inflation and high borrowing costs.

Globally, sputtering growth in Germany and signs of easing momentum in China following April data released on Tuesday have heightened concerns of a worldwide slowdown. Barclays Plc cut its second-quarter growth estimate for China to 1% from 5%, although others remain bullish on China’s recovery.

“We are still positive on the reopening story,” said Lucy Meagher, investment adviser for Evans and Partners Pty Ltd. “Investors might have hoped for a debt-fueled stimulus coming from the government in terms of the reopening. We are seeing it’s more likely to be a self-sufficient, consumer-led recovery.”

Key events this week:

- Eurozone CPI, Wednesday

- BOE Governor Andrew Bailey delivers keynote speech, Wednesday

- US housing starts, Wednesday

- US initial jobless claims, Conference Board leading index, existing home sales, Thursday

- Japan CPI, Friday

- ECB President Christine Lagarde participates in panel at Brazil central bank conference, Friday

- New York Fed’s John Williams speaks at monetary policy research conference in Washington; Fed Chair Jerome Powell and former chair Ben Bernanke to take part in panel discussion, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.1% as of 8:25 a.m. Tokyo time. The S&P 500 fell 0.6%

- Nasdaq 100 futures rose 0.1%. The Nasdaq 100 rose 0.1%

- Nikkei 225 futures rose 0.1%

- Hang Seng futures fell 0.1%

- S&P/ASX 200 futures fell 0.5%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0864

- The yen was little changed at 136.42 per dollar

Cryptocurrencies

- Bitcoin rose 0.3% to $27,030.35

- Ether rose 0.3% to $1,826.07

Bonds

- The yield on 10-year Treasuries advanced three basis points to 3.53%

- Australia’s 10-year yield advanced five basis points to 3.45%

Commodities

- West Texas Intermediate crude fell 0.3% to $70.67 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.