Stocks in Hong Kong and China-related markets look set to gain after President Xi Jinping stepped up support for the world’s second-biggest economy.

Futures for Hong Kong’s equity benchmark soared more than 3% after an index of Chinese companies listed in the US advanced the most in almost three months. Australian shares gained and contracts for Japan rose after the S&P 500 halted a five-day slide on Tuesday. Nasdaq 100 futures edged lower following mixed earnings that saw Microsoft Corp. climb and Alphabet Inc. drop in late US trading.

China’s plans include issuing additional sovereign debt and raising the budget deficit ratio. The nation has rarely adjusted its budget mid-year, having previously done so in periods including 2008, in the aftermath of the Sichuan earthquake and in the wake of the Asian financial crisis in the late 1990s.

Read More: Xi Steps Up Economic Aid With New Debt Issuance, PBOC Visit

Treasury 10-year yields edged lower on Tuesday, oil declined below $84 a barrel and Bitcoin briefly topped $35,000. Meanwhile, a Bloomberg gauge of the dollar advanced for the first day in four, extending gains after a reading of US business activity came in stronger than expected.

The Aussie dollar was the sole G-10 currency to gain against the greenback ahead of the release of key Australian inflation data Wednesday.

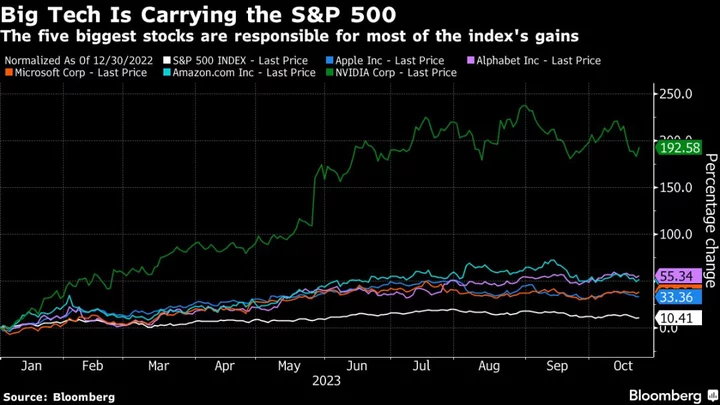

Investors looking to the US earnings season for a dose of good news are hanging their hopes on big tech. The five largest companies in the S&P 500 account for about a quarter of the benchmark’s market capitalization. Their earnings were projected to jump 34% from a year earlier on average, according to analyst estimates compiled by Bloomberg Intelligence.

“As these big tech stocks go, so does the overall market,” said David Trainer, chief executive officer of New Constructs. “If big tech companies blow their numbers out of the water and provide strong guidance for future earnings, then we could see the stock market rally strongly through the end of the year.”

US business activity picked up in October after back-to-back months of stagnation, helped by a rebound in factory demand and an easing in service-sector inflation.

“The US economy is generating growth, but it still must digest the ‘last mile’ of policy tightening in our view,” said Don Rissmiller of Strategas. “We would be more convinced that the growth we are seeing was high-quality or sustainable growth if the labor market was re-balanced (with labor demand equal to supply). Until then, the risk remains that continued restrictive monetary policy becomes too restrictive.”

Bank of Japan officials are likely to monitor bond yield movements until the last minute before making a decision on whether to adjust the yield curve control program at a policy meeting next week, according to people familiar with the matter.

Key events this week:

- Australia CPI, Wednesday

- Germany IFO business climate, Wednesday

- Canada rate decision, Wednesday

- US new home sales, Wednesday

- IBM, Meta earnings, Wednesday

- European Central Bank interest rate decision; President Christine Lagarde holds news conference, Thursday

- US wholesale inventories, GDP, US durable goods, initial jobless claims, pending home sales, Thursday

- Intel, Amazon earnings, Thursday

- China industrial profits, Friday

- Japan Tokyo CPI, Friday

- US PCE deflator, personal spending and income, University of Michigan consumer sentiment, Friday

- Exxon Mobil earnings, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 8:17 a.m. Tokyo time. The S&P 500 rose 0.7%

- Nasdaq 100 futures fell 0.3%. The Nasdaq 100 rose 1%

- Hang Seng futures rose 3.1%

- Nikkei 225 futures rose 0.4%

- Australia’s S&P/ASX 200 rose 0.4%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The Japanese yen was little changed at 149.86 per dollar

- The Australian dollar was little changed at $0.6358

Cryptocurrencies

- Bitcoin rose 1.4% to $34,114.39

- Ether rose 1.1% to $1,791.62

Bonds

- The yield on 10-year Treasuries declined three basis points to 4.82% on Tuesday

- Australia’s 10-year yield was little changed at 4.69% on Wednesday

Commodities

- West Texas Intermediate crude was little changed

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.