Asian stocks are poised to follow the US lower as Treasury yields soared after the latest inflation data bolstered bets on Federal Reserve rate hikes. Bonds in New Zealand and Australia joined the selloff in early trading Friday.

Shares in Australia slipped, while futures on benchmarks in Japan and Hong Kong both declined. The Golden Dragon index of Chinese companies listed in the US fell the most in a month. Elsewhere, US equity futures contracts were little changed after the S&P 500 fell for the first time in five days, with banks underperforming ahead of earnings from JPMorgan Chase & Co., Citigroup Inc. and Wells Fargo & Co. Friday.

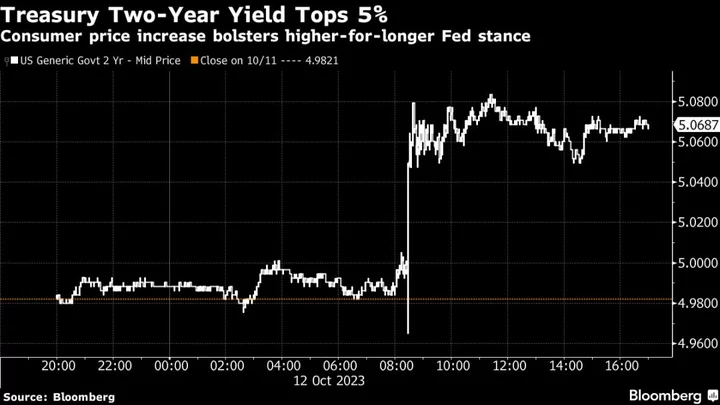

Treasuries dropped across the curve, with the 30-year rate surging as much as 19 basis points after a $20 billion auction of the securities drew weak demand. Swap contracts pushed the odds of another quarter-point Fed hike to about 40% — from closer to 30% Wednesday.

The dollar jumped, following its longest losing streak since March, with the Aussie and kiwi the worst performers among major counterparts and the yen approaching the 150 mark.

The so-called core consumer price index, which excludes food and energy costs, increased 0.3% last month. From a year ago, it rose 4.1%, the lowest since 2021. Economists favor the core gauge as a better indicator of underlying inflation than the overall CPI, which rose 0.4%, boosted by energy costs. Forecasters had called for a 0.3% monthly advance in both measures.

“As for how this will impact interest rates, at this point, ‘higher-for-longer’ may be more important than ‘how high?’ said Richard Flynn, managing director at Charles Schwab UK. “Whether or not the Fed opts for hikes, it’s unlikely we’ll see rates drop below where they are for as long as the inflation dragon proves difficult to slay.”

While swap contracts continue to anticipate a Fed pivot to rate cuts next year, that outcome was assigned somewhat lower odds.

For Tiffany Wilding at Pacific Investment Management Co., the CPI is likely to create some anxiety for Fed policymakers.

“We’ve been skeptical that the Fed would actually deliver the hike projected in the second half of 2023 by the majority of Fed officials, but at this point we are leaning toward them getting it in despite the recent tightening in financial conditions,” she noted. “It’s a very close call.”

On the day ahead in Asia, Chinese inflation and trade data are on the calendar, while Singapore’s monetary policy decision is also due. China’s consumer price inflation probably stayed near zero in September, while producer prices likely continued to fall, according to Bloomberg Intelligence. Trade data for September will most likely show the slump in exports eased.

Elsewhere, oil climbed in early Asian trading after falling Thursday as US crude stockpiles increased, providing a buffer against heightened geopolitical risks in Israel and Gaza.

Key events this week:

- China CPI, PPI, trade, Friday

- Eurozone industrial production, Friday

- US University of Michigan consumer sentiment, Friday

- Citigroup, JPMorgan, Wells Fargo, BlackRock results as the quarterly earnings season kicks off, Friday

- G20 finance ministers and central bankers meet as part of IMF gathering, Friday

- ECB President Christine Lagarde, IMF Managing Director Kristalina Georgieva speak on IMF panel, Friday

- Fed’s Patrick Harker speaks, Friday

Some of the main moves in markets as of 8:04 a.m. Tokyo time:

Stocks

- S&P 500 futures were little changed. The S&P 500 fell 0.6% on Thursday

- Nasdaq 100 futures were little changed. The Nasdaq 100 fell 0.4%

- Australia’s S&P/ASX 200 fell 0.4%

- Nikkei 225 futures fell 1.2%

- Hang Seng futures fell 2%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0532

- The Japanese yen was little changed at 149.78 per dollar

- The offshore yuan was little changed at 7.3090 per dollar

- The Australian dollar was little changed at $0.6315

Cryptocurrencies

- Bitcoin was little changed at $26,744.7

- Ether rose 0.1% to $1,538.19

Bonds

- Australia’s 10-year yield advanced 10 basis points to 4.47%

Commodities

- West Texas Intermediate crude rose 0.6% to $83.44 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.