Shares in Asia are set to rise after stocks and bonds rallied on Wall Street as traders trimmed bets on higher interest rates, providing a reprieve for investors after a string of declines.

Equity futures for Japanese and Australian shares climbed, while those for Hong Kong were little changed. Mainland China markets remain shut for a week-long holiday. The S&P 500 rose 0.8% Wednesday, its best session in almost three weeks, while the Nasdaq 100 advanced 1.5%, its biggest daily advance since August. US equity futures were little changed in early Asian trading.

Treasury yields dropped across the curve Wednesday, with those on 10- and 30-year debt both falling six basis points. The decline in yields pared a run of steep increases. The selloff in longer-maturity Treasuries has rivaled some of the most notorious market meltdowns in US history.

The easing of Treasury yields was helped by economic data that prompted traders to scale back forecasts for Federal Reserve tightening this year.

US companies added the fewest number of jobs since the start of 2021 in September, according to a survey from the ADP Research Institute in collaboration with Stanford Digital Economy Lab. A separate report from the Institute for Supply Management showed the services sector pulled back modestly last month to the lowest level this year. Those data releases come ahead of Friday’s nonfarm payrolls figures, which are forecast to show a slowdown in activity.

Bill Gross, co-founder and former chief investment officer of Pacific Investment Management Co., said retail investors that hold bonds in exchange-traded funds were adding to the pressure in Treasury markets over the past week. “We are seeing a little bit of oversold market” as 10-year Treasury yields approach 5%, he said in an interview with Bloomberg Television.

Traders will be keeping a close eye on the yen, after the currency spiked higher Tuesday following its slide beyond 150 per dollar. The surge prompted speculation Japanese officials had intervened to prop up the yen, but early indications show that may not have been the case.

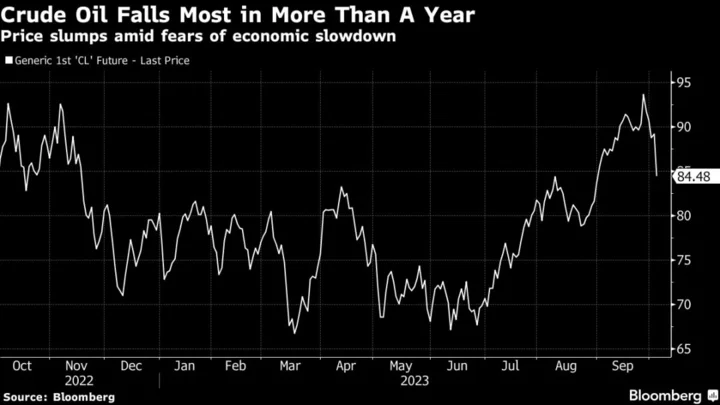

In commodities, West Texas Intermediate slumped 5.6% to settle below $85 a barrel Wednesday, the biggest one-day drop in more than a year. The decline reflects early signals that demand is flagging, exacerbated markets’ unease over the prospect of a punishing stretch of high interest rates.

Key events this week:

- China has week-long holiday

- France industrial production, Thursday

- BOE Deputy Governor Ben Broadbent, Riksbank First Deputy Governor Anna Breman participate at panel discussion, Thursday

- US trade, initial jobless claims, Thursday

- San Francisco Fed President Mary Daly speaks at the Economic Club of New York, Thursday

- Germany factory orders, Friday

- US unemployment rate, nonfarm payrolls, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.2% as of 7:07 a.m. Tokyo time. The S&P 500 rose 0.8%

- Nasdaq 100 futures fell 0.2%. The Nasdaq 100 rose 1.5%

- Nikkei 225 futures rose 0.9%

- Hang Seng futures fell 0.1%

- S&P/ASX 200 futures rose 0.4%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro was little changed at $1.0507

- The Japanese yen was little changed at 149.00 per dollar

- The offshore yuan was little changed at 7.3172 per dollar

Cryptocurrencies

- Bitcoin rose 0.2% to $27,717.57

- Ether rose 0.1% to $1,644.53

Bonds

- The yield on 10-year Treasuries declined six basis points to 4.73%

- Australia’s 10-year yield declined eight basis points to 4.58%

Commodities

- West Texas Intermediate crude rose 0.3% to $84.49 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.