Futures for Asian share markets pointed to declines Friday after surprisingly strong private hiring data in the US roiled Wall Street, pushing down equities as Treasury yields moved sharply higher.

Contracts for Japan and Australia suggest drops of more than 1% at the open, while those in Hong Kong indicate a slightly small decline. Investors in Chinese assets will also be watching the meeting of US Treasury Secretary Janet Yellen and Premier Li Qiang in Beijing for any signs of improvement in the frayed trade ties of the two superpowers.

The S&P 500 and Nasdaq 100 benchmarks each notched losses of 0.8% on Thursday after ADP Research Institute numbers showed US companies added the most jobs in over a year in June, underscoring the inflationary threat from the strong labor market.

“The selloff is driven by the idea that the economy is a freight train that can’t be stopped and that the Fed is going to have to work even harder,” said David Donabedian, chief investment officer of CIBC Private Wealth US. “And you certainly see that in the bond market, where you have an even more dramatic reaction.”

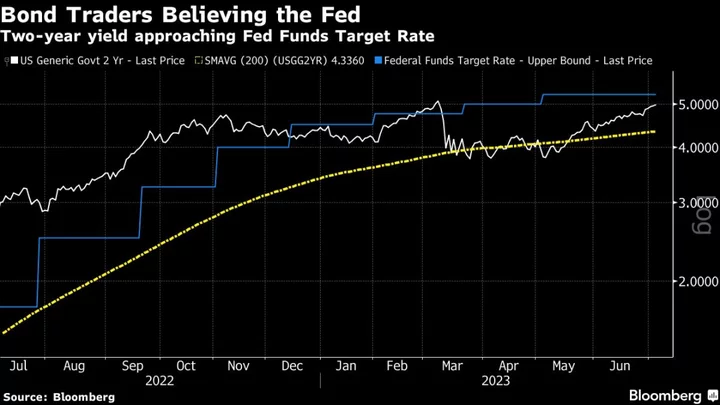

That saw swap contracts linked to future policy decisions almost fully price in a quarter-point interest rate increase from the Federal Reserve by July 26 and showed a growing likelihood of an additional hike by year end. This expectation for higher rates is reinforcing bets on tighter monetary policy globally as central banks struggle to bring inflation back within targeted ranges.

In a taste of potential moves to come elsewhere Friday, government bond yields in New Zealand jumped about eight basis points for two-year and 10-year maturities.

Currencies were broadly steady in early Asian trading after a gauge of dollar strength touched its highest level in about four weeks Thursday. The yen was also little changed after being the best performer among Group-of-10 currencies in the prior session, supported by comments from the Bank of Japan about a “balanced” approach toward yield curve control.

US Treasury yields on Thursday rose across the curve after the ADP report and data showing the service sector expanded in June at the fastest pace in four months. The policy sensitive two-year rate ended the day just short of 5% after touching a 16-year high while the yield on the 10-year rose to 4.03%.

Dallas Fed President Lorie Logan voiced her concerns that inflation was still running too hot and more rate hikes were needed at an event in New York Thursday. Stocks have been losing ground in July after a strong first half of the year as continued hawkishness from central banks dampens hopes of a soft landing for the global economy.

Traders will be on tenterhooks for Friday’s US nonfarm payrolls and unemployment reports to see if they reinforce or reduce pressure on the Fed to raise rates soon. Economists surveyed by Bloomberg are expecting figures to moderate. Earlier this week, minutes from the Fed’s June meeting showed division among policymakers over the decision to pause rate hikes, with the voting members on track to take rates higher later this month.

Despite the uncertainties, there’s a number of ways to participate in equities right now, according to Liz Ann Sonders, chief investment strategist at Charles Schwab, who said she has been particularly “factor-focused.”

“We think focusing on those quality-based factors with span both on the growth factor side of things and the value factor side of things is the way to approach what you are doing inside your equity allocation,” she told Bloomberg TV.

In after-hours trading, Levi Strauss & Co. slumped as the denim retailer slashed its outlook for the year while Costco Wholesale Corp. dipped after monthly sales missed estimates.

Key Events This Week:

- US unemployment rate, nonfarm payrolls, Friday

- ECB’s Christine Lagarde addresses an event in France, Friday

Some of the main moves in markets today:

Stocks

- S&P 500 futures fell 0.1% as of 7:30 a.m. Tokyo time. The S&P 500 fell 0.8%

- Nasdaq 100 futures fell 0.1%. The Nasdaq 100 fell 0.8%

- Nikkei 225 futures fell 1.1%

- Australia’s S&P/ASX 200 Index futures 1.3%

- Hang Seng Index futures fell 0.6%

Currencies

- The euro was little changed at $1.0890

- The Japanese yen was little changed at 144.06 per dollar

- The offshore yuan was little changed at 7.2558 per dollar

- The Australian dollar was little changed at $0.6625

Cryptocurrencies

- Bitcoin fell 0.2% to $30,246.27

- Ether fell 0.5% to $1,874.75

Bonds

- The yield on 10-year Treasuries advanced 10 basis points to 4.03%

Commodities

- West Texas Intermediate crude was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Peyton Forte and Isabelle Lee.