Federal Reserve officials are ready to take a breather after more than a year of driving up interest rates, a move that’s likely to be accompanied by a strong signal that they’re prepared to keep hiking if needed.

Policymakers are expected to leave rates in a range of 5% to 5.25% at their June 13-14 meeting, allowing them to take stock of the outlook following recent strains in the banking sector. But Chair Jerome Powell will also have to placate a number of officials who worry progress on inflation has stalled and say the Fed may need to do more to cool a surprisingly resilient economy.

“They seem intent on taking a time-out at the June meeting next week to continue to assess banking sector stresses and make sure there aren’t any lurking issues,” said Brett Ryan, senior US economist at Deutsche Bank AG. “But with a stronger labor market and really no signs of progress in those inflation metrics that Powell has highlighted, the Fed’s got more work to do.”

Fed officials have recently voted in unison, save for two isolated dissents last year, and often spoken in similar ways about their commitment to bringing down inflation.

But with interest rates close to or at the level officials see as high enough to restrain the economy, different views are emerging about just how much further to go, raising the prospect of a dissent at an upcoming meeting.

Growing Fissures

A key question for policymakers is the extent to which the banking strains are contributing to a pullback in lending that was already underway.

While so far that hasn’t had a huge impact on credit conditions, those effects could take time to show up in the economy, Fed Governor Christopher Waller said.

“Over four months will have passed between the Silicon Valley Bank failure and the July meeting,” Waller said May 24. “By then we will have a much clearer idea about credit conditions. If banking conditions do not appear to have tightened excessively, then hiking in July could well be the appropriate policy.”

Powell made a similar argument in a May 19 panel discussion, when he said the Fed’s actions so far give it time to move a bit more slowly to better assess the impact of previous rate increases and the banking stress on the wider economy.

Read more: Powell Steers Policy Debate With Clear Signal on June Rate Pause

While most officials on the Federal Open Market Committee seem to agree with this reasoning, a small group of policymakers have expressed growing unease about the lack of disinflation.

“I remain concerned about whether inflation is falling fast enough,” Dallas Fed President Lorie Logan, who votes on policy this year, said in a May 18 speech. “The data in coming weeks could yet show that it is appropriate to skip a meeting. As of today, though, we aren’t there yet.”

Governor Michelle Bowman last month also warned that neither prices nor the workforce were showing sufficient signs of cooling. St. Louis Fed President James Bullard, Minneapolis chief Neel Kashkari and Cleveland’s Loretta Mester have also kept the door open to supporting a rate increase in June. Bullard and Mester don’t vote on policy this year, but they both take part in FOMC deliberations and are seen as influential voices on the Fed’s policy-setting committee.

While “no” votes from regional Fed presidents are fairly common, dissents from Bowman or Waller — who is also seen as one of the committee’s more hawkish members — would be the first by a Fed governor since 2005.

Gaining traction

Their views have gained traction in recent weeks. After the Fed’s May 2-3 meeting, investors and economists assumed that once policymakers stopped raising rates, they would hold them for some time before eventually cutting them.

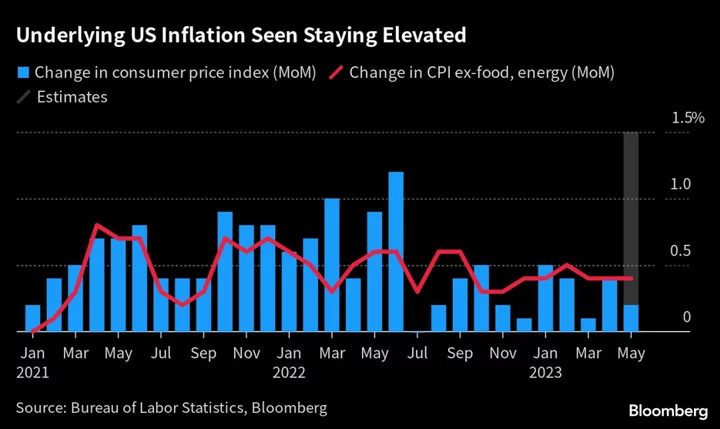

Since then, however, inflation and labor-market data have both come in hotter than expected.

The Fed’s preferred inflation gauge, the personal consumption expenditures index, rose at a 4.7% pace on a 12-month basis in April, excluding food and energy costs, nudging up from 4.6% in December. A measure of core services inflation watched carefully by Powell has barely budged since last year. And a Labor Department report showed employers added 339,000 jobs in May, well above economists’ estimates.

The stronger data, along with pointed signals from Powell and Fed Governor Phillip Jefferson, helped shift expectations from a Fed pause to a skip.

The challenge now will be for Powell to communicate that the Fed isn’t done, even if it forgos an increase in June.

While officials’ post-meeting statement, to be released Wednesday at 2 p.m. in Washington, may not change much — the previous one nodded to the possibility of “additional policy firming” — Powell could use his press conference to lean into the chance of a July hike.

Policymakers could also signal their expectations for higher rates through updates to their economic forecasts, which they will release following their two-day meeting this week. In March, seven of 19 officials projected rates would finish the year above where they are now, and it would only take a few upward revisions to move the median estimate even higher.

Read more: Fed Poised for Big Upgrade to Outlook Despite Swirling Risks

One wrinkle to the Fed’s planning is the release of the May consumer price index report on Tuesday, the first day of the FOMC meeting. A hot reading would probably raise the odds that officials ditch their plan for a pause, and instead forge ahead with another 25-basis-point hike.

“The subtle differences in how people view things and the differences in view points about how much weight to put on the two risks — the risk of going too far versus the risk of not going far enough — those are going to come out more clearly when you’re close to a turning point,” said Stephen Stanley, chief US economist at Santander US Capital Markets in New York.