Apple Inc. is now alone among global smartphone brands without a foldable device in its portfolio, putting it on the sidelines of a trend that promises to generate tens of billions of dollars in coming years.

With Alphabet Inc.’s Google launching the Pixel Fold at an event Wednesday, every major brand running the Android operating system has now adopted the form factor. And though Apple began early work on a foldable iPhone years ago, it’s shown little interest in racing a product to market.

The approach isn’t unusual for Apple, which often takes its time and then jumps into an established category with a more polished product. That was the case with the iPhone itself in 2007. The company also has less incentive to tinker with its current iPhone lineup since it dominates the market for premium smartphones.

But Apple could soon find itself years behind rivals in a promising segment. Though foldable phones are still a tiny fraction of the market, they command higher prices and open the door to new features, helping lower-tier brands step up into the premium range. Market observers expect the segment to be the fastest-growing area in an otherwise shrinking smartphone field.

The question is whether Apple will ultimately help solidify the foldables concept or miss out on it, said Neil Mawston, director of research at Strategy Analytics.

“Apple has the power to make or break the future foldables industry,” he said. “Launch too early, and a market-unready foldable could trash the whole iPhone franchise. If Apple does not have a foldable iPhone or iPad on sale by 2025, when industry revenues will approach tens of billions of dollars, then we’d start to get a little worried.”

Apple, based in Cupertino, California, didn’t immediately respond to a request for comment.

The company makes the majority of its revenue from the iPhone lineup — which is incrementally improved annually and hasn’t made major leaps in design or function for years. So far, foldables have yet to reach large enough volumes to take meaningful share away from Apple, which controlled 77% of the market for phones above $751 last year, according to Omdia analyst Jusy Hong.

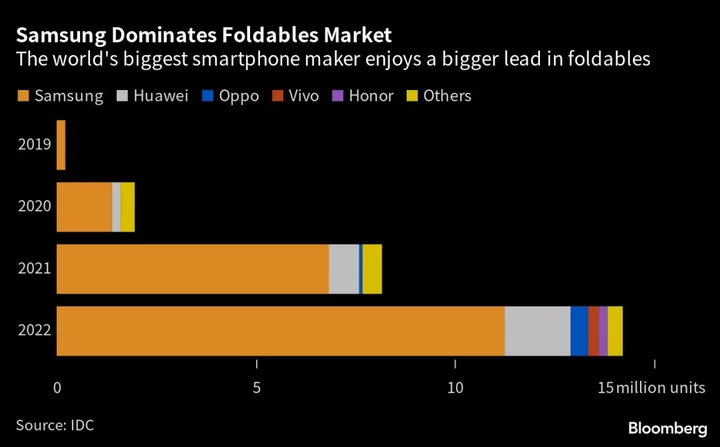

For now, foldables are an Android-only contest, dominated by Samsung Electronics Co. on the global stage. But competition is more intense in China, where local brands are using such devices to go upscale. Xiaomi Corp., Huawei Technologies Co., Vivo and Oppo each have several models on the market now. Honor, an independent brand spun off from Huawei in 2020, is also helping make the segment more affordable with its Honor Magic Vs device this year.

Chinese brands face increasing pressure to differentiate their products and encourage users to upgrade, especially as the broader phone industry stalls. The domestic smartphone market suffered double-digit shipment declines over the past year. And unlike Apple, which has fostered a virtuous cycle of customers upgrading their iPhones every couple of years, the more fungible Android brands have to win customers anew with every new device. A foldable option helps do that.

Read More: Weak Singles’ Day Smartphone Sales Hint at Lengthy Sector Slump

That’s evident at a company like Oppo, the largest smartphone maker in China.

“Foldables are the future and are of utmost importance to Oppo’s overall product strategy,” said Billy Zhang, president of overseas sales and services at Oppo. His sentiment is echoed by Honor, which expects China to be the first market where foldables start to lead the premium segment. Close collaboration with local suppliers helps improve portability and affordability quickly, according to an Honor spokesperson, and 90% of the top 5,000 apps in China have already been adapted for foldable devices.

The development of foldable devices is capital-intensive, as it requires the design and refinement of hinges that are durable and thin. There are further innovations required, such as Samsung’s ultrathin glass screen cover, which allows for the familiar glass-like feel on a surface that’s able to bend and flex.

Google’s involvement in the foldable segment had until this week been limited to software. The Alphabet-owned company is responsible for developing Android and has been collaborating with Samsung since the 2019 introduction of the first Galaxy Fold handset to make the operating system and its apps work with such devices. Its own Pixel Fold may provide welcome competition to Samsung, which still enjoys a first-mover advantage and a 79% share of the global market, according to IDC’s Bryan Ma.

Read more: Google Enters Foldable Market With $1,799 Phone to Rival Samsung

For Apple, its first entry into this category is more likely to be a tablet than a foldable iPhone, according to mobile industry veteran and CCS Insight analyst Ben Wood and Omdia’s Hong. Wood expects a “super-premium iPad with a flexible display” in 2024. Hong, meanwhile, sees the crease in the middle of foldable screens as a major obstacle to Apple’s adoption. That imperfection is much improved since first-generation Samsung devices, but it lingers even in the latest models. And the iPhone maker is famously demanding in its choices of display technology.

“It is unthinkable that Apple has not been experimenting with flexible display technology in its product development labs for a decade or more,” Wood said. “The strength of the existing iPhone portfolio and the high margins it commands obviates the need for Apple to react to rival folding smartphone devices.”

Read More: Fancy Phones Are the New Object of Revenge Spending

--With assistance from Mark Gurman.