Amundi SA’s onshore Chinese wealth management business is improving “significantly” this year after facing very challenging conditions in 2022, its local head said.

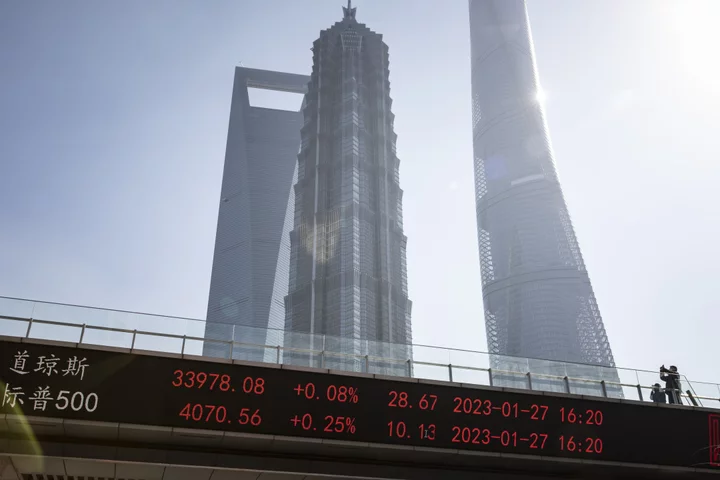

With a better regulatory environment, “we’re entering a new era with more long-term, more sustainable growth,” Greater China Chairman Zhong Xiaofeng said at the Bloomberg Wealth Asia Summit in Hong Kong on Tuesday.

The Paris-based $2.1 trillion manager is refocusing on growth in China as the country emerges from Covid challenges. Its earlier plan to more than double assets in Greater China by 2025 remains unchanged and it’s “on track” to meeting the goal, Zhong said.

Amundi managed about $120 billion in China, Hong Kong and Taiwan in 2021.

Zhong said he’s also “confident” that Europe’s largest asset manager can continue to navigate new challenges in China amid rising geopolitical tensions “in a sustainable way,” after more than four decades operating in the market.

China stands at the heart of Amundi’s expansion in Asia, where it wants to increase assets to 500 billion euros ($549 billion) by 2025. Its wealth management joint venture with Bank of China Ltd. was approved by regulators in 2019, adding to a fund management venture with the Agricultural Bank of China Ltd.