It promised to be a good year for airlines with travel demand returning and the Covid pandemic fading into the horizon. What no one saw coming was the industry’s original nemesis making a big comeback.

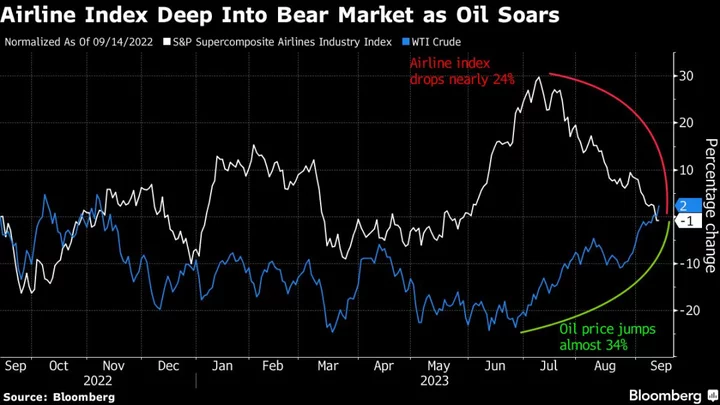

As the price of oil surged in the past three months, most rapidly after Saudi Arabia and Russia earlier this month extended their supply cuts, shares of airline companies have taken a beating. Earlier this month, a gauge for airline stocks — the S&P Supercomposite Airlines Industry Index — tumbled into a bear market, extending a steady and fast decline from the most recent highs touched in mid-July.

Several major US carriers this week slashed their profit outlooks for the third quarter, blaming the sudden jump in oil prices as well as rising labor costs and weak demand for domestic travel. At the same time, analysts’ average 2023 profit estimate for US airlines has fallen 8% since the beginning of July, according to Bloomberg Intelligence data. Expectations for 2024 earnings have dropped 10% in that same period.

“Fuel is the biggest risk to airline profits right now,” Bloomberg Intelligence analyst George Ferguson said in an interview. “Airlines had lower fuel prices dialed into ticket prices for the third quarter and then oil moved dramatically. I don’t think airlines saw it coming.” Jet-fuel makes up roughly 25% of major US airlines’ annual operating expenses, but had risen to nearly 30% in the first quarter of 2023, before dipping closer to 20% in the second quarter, according to BI data. Ferguson expects that percentage to climb back up again in the last two quarters of the year.

The airline index is down 24% from its closing high of July 11 through Thursday’s close, with the broader S&P 500 Index up 1.5% over the same period. The airline index has seen a worse performance over a similar span only one other time — the nine weeks ending in June 2022 — since the Covid-related shock, according to Bespoke Investment Group.

The group rebounded on Friday, slightly paring some of the decline, led by the larger carriers — United Airlines Holdings Inc., Southwest Airlines Co. and Delta Air Lines Inc.

Read more: Oil Rally Picks Up Steam as US Benchmark WTI Hits $90 a Barrel

The latest rise in the price of oil comes at a time when airlines are also struggling with high labor costs and falling demand for domestic travel as US consumers get squeezed by high inflation. This week’s inflation data showed airfares ticked up again in August, sparking concern among analysts about flyers’ ability to afford air tickets, which in turn limits carriers’ ability to pass on the rising costs to passengers.

“If the consumer has some strength, you would look for fares to be increased to cover fuel,” BI’s Ferguson said. “But my guess is that the consumer isn’t strong enough to bear a large increase.”

On the other hand, some are of the opinion that the rush of third-quarter warnings and the recent selloff have removed uncertainties and positioned the stocks for some gains. In fact, the airline index has now moved into a so-called oversold zone — a technical indicator that suggests the gauge has fallen too far, too fast — indicating it may be due for a reversal. The airline index is still trading 46% below its pre-pandemic levels through the last close, even as the S&P 500 has advanced 33% over the same time.

Even so, any sustained recovery in airline stocks may still take a while, market strategists say, especially as oil remains a wild card, the outlook for air-travel stays murky, and investors turn to other sectors with fewer uncertainties and stronger cash flows.

And the rally in oil prices that is eating into airline companies’ profits is also helping to lure investors away from airline stocks. The US Global Jets ETF (JETS) of airline stocks has lost assets for 16 straight months, while both the Vanguard Energy ETF (VDE) and the iShares Global Energy ETF (IXC) have seen money flowing into them in July and August.

“They are losing out in pure competition for capital,” Todd Sohn, ETF strategist at Strategas, said in an interview, noting that investors are instead flocking to energy stocks. “Energy’s gain is airlines’ pain.”