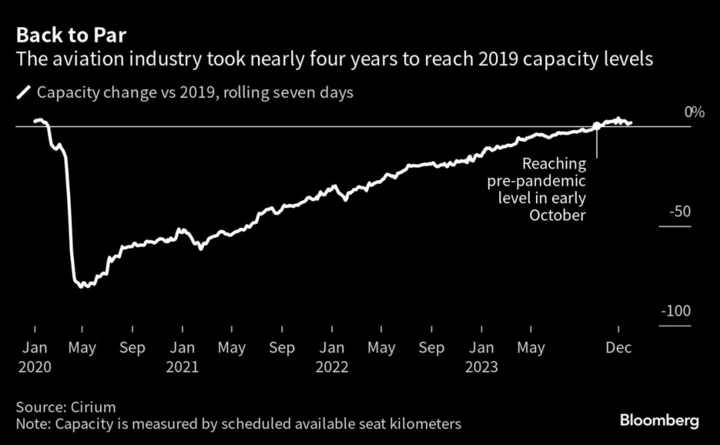

Four lost years. That’s how long it’s taken the aviation industry to get back to where it stood before the pandemic.

This week, global airline capacity is poised to finally surpass its corresponding 2019 levels, based on data from aviation analytics firm Cirium. The moment marks a major milestone in the recovery from the Covid-19 outbreak, which threw the world’s $1.17 trillion travel market into an unprecedented, existential crisis. Widespread border closures forced airlines to park their fleets, driving the industry to the brink of collapse.

The spasms that followed, from travel lockdowns and airline bailouts to fitful reopenings cut short by new Covid strains, left the sector financially weakened and understaffed. When cooped-up travelers finally broke loose last summer, airlines and airports were unprepared, leading to schedule disruptions and chaos in terminals.

The return to pre-pandemic flight capacity — the number of seats being offered multiplied by distance flown — speaks to airlines’ resilience and ability to adapt to ever-shifting conditions.

Still, it’s become a tougher industry in many respects. Travel to and from China remains depressed, keeping a major market largely on the sidelines of the recovery. Airlines have struggled with persistent aircraft-supply bottlenecks, a headache left over from the pandemic. And Russia’s airspace is now closed for many Western airlines, adding to a host of post-pandemic challenges.

Industry profit will be less than 40% of 2019’s level this year, according to the International Air Transport Association. Business travel still hasn’t fully recovered, and it’s unclear when — or indeed if — it will.

With prospects for a corporate rebound uncertain, operators are squeezing what they can from leisure’s fading revenge-travel boom. Jetliner delivery delays and recent engine issues are clouding growth prospects and keeping older planes in service. Labor, jet fuel and debt service are growing more expensive.

“Industry revenues are back to 2019 levels but costs are over 2019 levels by about 18 or 19%,” US airline analyst Helane Becker at TD Cowen said in a Bloomberg Television interview. “Pay is going up like 35, 40% — which is insane. I’ve seen this movie before, and this is not sustainable.”

China, the world’s biggest source of outbound tourism in 2019, has only started to return to the world stage. The Asian colossus was among the first markets to shut its borders in early 2020 and among the last to ease international restrictions early this year, prioritizing its domestic recovery first. A ban on group tours to overseas destinations like Australia, the US and the UK was just lifted in August.

So far, Chinese travelers have been hesitant to embark on expensive overseas trips, after stringent controls during the pandemic scarred the nation’s economy and psyche. Similarly, China’s appeal to tourists from North America and Europe has been limited by the prospect of visa hassles, inconvenient payment systems and a lack of flights.

China cross-border travel may take another year to fully recover, World Travel & Tourism Council Chief Executive Office Julia Simpson said in a Sept. 19 interview.

Read more: China’s Open for Travel But Few Tourists Are Coming or Going

China’s traffic with the US and Canada was about one-tenth its pre-pandemic level in September, according to OAG, which tracks aviation trends.

Geopolitical tensions have played a role with the US. The number of weekly round-trip flights between the two major trade partners is set to rise to 24 for each nation by the end of October. Before Covid, the weekly flights between them averaged 340.

The numbers aren’t much better in France or Japan, though nearby Thailand is getting a boost after temporarily relaxing visa rules for Chinese visitors. It’s among the popular destinations that are likely to gain from the removal of China’s group-tour ban, said John Grant, chief analyst at OAG.

Another major reason aviation’s international recovery has lagged domestic markets is Russia’s invasion of Ukraine.

US and European carriers can no longer fly to Russia or use its airspace on the way to Asia, adding to costs and lengthening routes as they go around. Carriers in China, the Middle East and India aren’t subject to the Russian ban.

“It’s no longer a level playing field,” said Guillaume Faury, chief executive officer of planemaker Airbus SE, at a Sept. 12 event in the US. “Every airline has a different situation to manage.”

As of September, cross-border capacity is down 8% globally from 2019 levels, according to Cirium. Trans-Atlantic traffic has caught up to pre-Covid levels, while Trans-Pacific and Europe-to-Asia are down 31% and 17%, respectively. Big US carriers and European airlines like Finnair Oyj, once a specialist on trips to Asia, have had to redeploy planes on other routes.

Flight times to destinations such as Japan, South Korea and China have increased 30-40%, Finnair CEO Topi Manner said at an event in London. The airline has kept just one-third of its Asian foothold, while refocusing on the US, Middle East and India, he said.

One spot Chinese airlines have targeted for a comeback is the UK, taking advantage of access to Russian airspace. Air China Ltd., China Southern Airlines Co. and China Eastern Airlines Corp. all offer more seats than they did pre-pandemic.

British Airways, once the second-largest operator on flights to China, offers almost 40% fewer seats on those routes now than before Covid, based on Cirium data.

The UK was one of the biggest destinations for Chinese tourists pre-pandemic, and as tour groups head overseas again, the Chinese carriers are looking to tap that demand,” said aviation consultant John Strickland. Chinese carriers, not subject to the Russia airspace ban, are “spending less on fuel and have shorter flight times.”

While the capacity has been restored, passengers haven’t filled all those seats. The number of bookings from China to the UK were tracking at about 43% of 2019 levels in September, according to VisitBritain, the national tourism agency. That’s up from 6% in January.

In Europe, discounters Ryanair Holdings Plc and Wizz Air Holdings Plc are stoking competition, expanding their fleets quickly coming out of the pandemic. The same is true for their US counterparts Spirit Airlines Inc. and JetBlue Airways Corp.

“Their simplified operating model, minimal reliance on connecting traffic and multiple operating bases in many countries allowed them to get ahead of legacy carriers, timing their capacity growth to the opening of markets where possible,” said OAG’s Grant.

Besides adding planes, stronger players are consolidating. In the US, JetBlue is seeking to acquire Spirit, creating the fifth-largest US carrier based on domestic passenger traffic. Europe’s big three carrier groups, Air France-KLM, British Airways owner IAG SA, and Deutsche Lufthansa AG , are taking weaker rivals under their wing.

Read more: Air France-KLM’s Nordic Foray Gives Boost to Consolidation

In fast-growing India, budget carrier IndiGo is increasing its dominance by mopping up business from weaker players. A resurgent Air India Ltd., now owned by Tata Sons, bought out AirAsia India and plans to absorb the Tatas’ Vistara venture with Singapore Airlines Ltd.

Airlines that ordered planes before the pandemic are in better position to grow. Boeing Co. was already behind on production because of the 737 Max grounding in 2019, and neither it nor Airbus have recovered to earlier output levels.

Waits for new aircraft have risen, and airlines have been racing to place orders and secure delivery slots beyond the end of this decade.

Supply strains left over from the pandemic combined with recent jet-engine issues have slowed deliveries and led carriers to idle planes for maintenance. The result is a lack of available aircraft, crimping growth and forcing older planes to remain in fleets for a longer time.

“Airlines can’t get hold of their new aircraft as quickly as planned,” said Rob Morris, head of consultancy at Ascend by Cirium. “This has also caused a shortage of used aircraft.”

The number of planes in the global fleet that are 20 years old or more has risen by 25%, according to Cirium, while those younger than 10 years old are 2.7% fewer. Overall, the average age of a commercial jetliner is 10.8 years, compared with 10 in 2019.

Aging aircraft won’t help the industry make progress toward its goal of reaching net-zero carbon-dioxide output by 2050. The return of air traffic to 2019 levels, even as production of more efficient new-generation jets remains below pre-pandemic levels, underscore the uphill climb toward sustainability.

Global flight capacity is projected to grow 3.6% annually between 2019 and 2041, while CO2 emissions will rise — not fall — at a rate of 2.7%, according to Cirium.

Costly fuel alternatives to jet kerosene will be required to change that trajectory. That, along with fees imposed on CO2 emitters, will be passed down to passengers, said Cirium’s Morris — creating another potential drag on growth.

Read more: Airlines to Hand Passengers $5 Trillion Bill for Greener Travel

Cooling demand presents a fresh challenge. After peaking in May 2022, US air fares have fallen below 2019 levels — even as cost inflation takes a growing bite out of profits. In August, ticket prices were about 5.3% below the same month in 2019, based on the US consumer price index.

It’s an issue for airlines because fuel prices and labor costs are both on the rise. Delta Air Lines Inc. and American Airlines Group Inc. are among the carriers that have lowered their profit outlooks in recent weeks. In Europe, airlines have begun discounting tickets as demand weakens into fall.

While prices on shorter routes are a mixed bag, fares on popular long-haul routes remain robust, a Bloomberg analysis of Cirium data shows.

“Revenge travel has come to an end, but this doesn’t mean that demand is going down,” Guliz Ozturk, CEO of Turkish low-cost carrier Pegasus Hava Tasimaciligi AS, said in a Bloomberg Television interview.

While customers have become more price sensitive, they’re still traveling -- extending the summer season into typically slower months of October and November. “Going forward, looking into the future, the demand is there,” she said.

--With assistance from Jie Hou, Siddharth Vikram Philip, Mary Schlangenstein and Kate Duffy.